I will cover the topic of How to Use Cross-Chain DeFi. Cross-Chain DeFi allows users to harness the power of DeFi on several different blockchains.

Here, users will learn how to bridge assets and participate in yield farming and learn how to manage their tokens in a secure manner.

For the sake of beginners, I have provided a guide detailing the key steps, tools, and best practices to ensure users navigate DeFi with optimum efficiency.

Understanding Cross-Chain DeFi

Cross-Chain DeFi is a new area of decentralized finance that enables users to obtain financial services across several blockchains rather than being confined to a single blockchain.

Most of the DeFi services are built on one blockchain, such as Ethereum or Binance Smart Chain, confining users to the assets and liquidity of that blockchain. With the advent of Cross-Chain DeFi, the exchange of assets, data, and tokens across different blockchains is possible.

This is done through cross-chain bridges that securely lock tokens on one chain and mint them on another, thus allowing users to access multiple ecosystems. Other than the bridges, users are also able to access DeFi services through multi-chain wallets and interoperability protocols that significantly enhance usability.

There are a lot of advantages to cross-chain DeFi. Users are able to tap into larger liquidity pools and earn higher profits through yield farming. Users can lend, borrow, or stake on various chains, all without having to first convert their assets.

Peak capital efficiency is achieved, and reliance on a particular chain’s performance is reduced. This also allows for more creative and varied financial products to be developed. These advantages cannot be denied, but we must be aware of the risks they carry.

These include potential slippage, smart contract vulnerabilities, weak bridges, and the possibility of higher cross-chain fees. This is the DeFi of the future, as it offers a level of interoperability and opportunity flexibility that we cannot ignore, making it pivotal to the multi-chain crypto landscape.

How to Use Cross-Chain DeFi

Example: Bridging ETH to BSC and Yield Farming

Step 1: Choose a Multi-Chain Wallet

- To begin, download and install a wallet such as MetaMask or Trust Wallet to access multiple blockchains.

- After this, secure your wallet by storing your seed phrase safely offline.

Step 2: Connect to the Cross-Chain Bridge

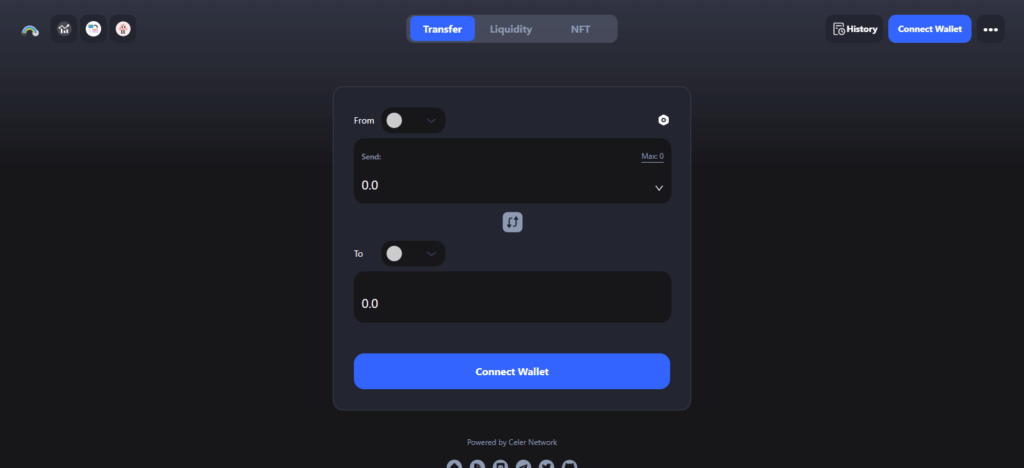

- Start by accessing a trusted cross-chain bridge, such as AnySwap, cBridge (Celer), or Multichain.

- Next, link your wallet to the platform.

Step 3: Select the Tokens and Networks

- Select the token for transfer (in this case, ETH).

- Then, select the blockchains (source: Ethereum and destination: BSC).

Step 4: Initiate the Bridge Transfer

- Provide the amount of ETH you are looking to bridge.

- Next, check the fees for the transaction and authorize the transfer.

- After this, you will need to wait as the bridge locks your Ethereum and mints equivalent ETH on BSC (BEP-20 format).

Step 5: Verify the Assets on the Destination Chain

- You will need to adjust your wallet and switch to the Binance Smart Chain.

- Ensure the ETH you bridged shows up in the wallet as a BEP-20 token.

Step 6: Join DeFi Activities (Yield Farming)

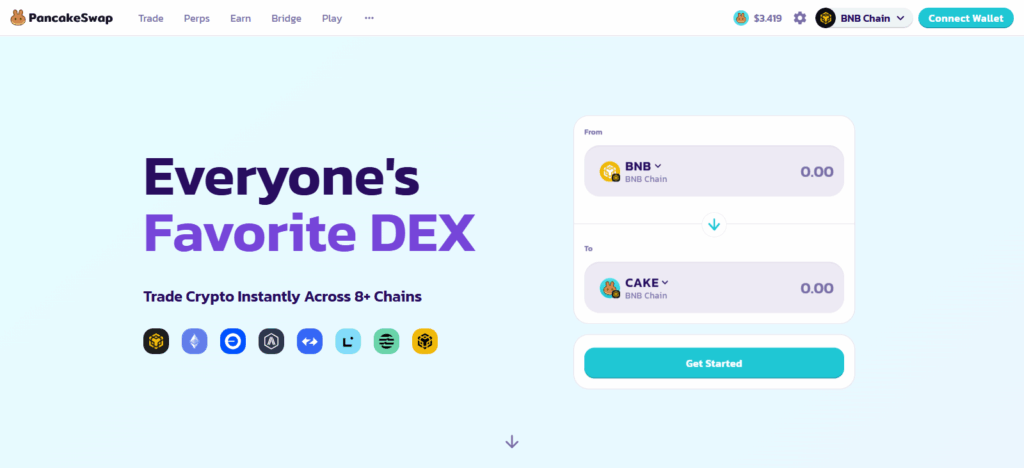

- Head over to a DeFi platform on the BSC, for example, PancakeSwap.

- Link your wallet, then go to the yield farming or liquidity pool section.

- Put your ETH in a liquidity pool (for example, ETH/BNB pair) to earn rewards.

Step 7: Oversee and Control Your Position

- Regularly oversee your yield farming rewards.

- Be cautious of the impermanent loss and the token value fluctuation.

- When you wish, you can withdraw your assets, as long as they are on BSC or bridged back to Ethereum.

Key Components of Cross-Chain DeFi

Cross-Chain Bridges

- Security protocols passing over tokens and information across a diverse range of blockchains.

- Allow people to utilize resources from one blockchain to another.

Multi-Chain Wallets

- Wallets which facilitate numerous blockchains, enabling the user to save and oversee various tokens from various blockchains in a single wallet.

- Examples: MetaMask, Trust Wallet, and Coinbase Wallet.

Interoperability Protocols

- Protocols which allow distinct blockchains to conversate and interact in a cohesive manner.

- Ensuring the compatibilities of decentralized applications (dApps) across systems.

Liquidity Pools

- The ability to provide liquidity to pools of assets spanning numerous blockchains to gain a reward.

- Cross-chain liquidity pools facilitate assessments of capital and promote superior profitability.

Wrapped Tokens

- Tokens that are pegged to assets of another blockchains (e.g. BEP-20 ETH on BSC as ETH).

- Wrapped Tokens provide the ability of letting one chains assets to be utilized on another chains and arch the original token.

Decentralized Exchanges (DEXs) on Multiple Chains

- DEXs that provide the trading for cross-chain assets.

- Users are enabled to swap, lend and farm tokens that are spread over blockchain systems.

Cross-Chain Oracles

- Price feeds and data across several blockchains.

- Facilitates reliability in the operations of DeFi protocols when dealing with different chains.

Best Practices and Tips

Use Trusted Bridges and Platforms

Use well-known and safe cross-chain bridges and DeFi platforms to minimize the chances of hacks and scams.

Double-Check Addresses

Ensure you are sending tokens to the correct wallet address and to the correct chain. A small mistake can result in an irreversible loss.

Secure Your Wallet

Keep your seed phrase and private keys stored in an offline location and never share them. For additional security, think about using a hardware wallet.

Monitor Network Fees

Network and blockchain gas fees are important to consider. Keep an eye out for lower transaction cost periods to execute your transactions.

Start Small

Before performing complex DeFi strategies or large bridges, first conduct small tests with a small number of tokens.

Diversify Across Chains

Spread your assets in different chains to minimize the risks of losing everything if a chain becomes congested.

Keep Track of Transactions

To make sure your transfers are complete and your DeFi transactions are done, use a blockchain explorer to check.

Understand Risks Associated with Protocols

Familiarize yourself with smart contract risks, bridge exploits, and liquidity pool impermanent loss.

Employ Trusted Wallet Extensions or Applications

Ensure that your wallet application, or browser extension is current and only downloaded from official and trusted sources.

Have Exit Strategies

Always preplan and identify the safest methods to withdraw and bridge your assets whenever market conditions or protocol risks evolve.

Common Risks and How to Mitigate Them

Bridge Exploits and Hacks

- Risk: Cross-chain bridges can be hacked, jeopardizing the safety of funds.

- Mitigation: Use bridges that have a good reputation and have been audited; do not transfer large amounts at once.

Smart Contract Vulnerabilities

- Risk: There may be flaws in the coding of DeFi protocols that can be exploited.

- Mitigation: Use protocols that have audits done by reputable security companies; to test safety, start with small transactions.

Slippage and Price Impact

- Risk: Traders do not anticipate price changes during large trades within low-liquidity pools.

- Mitigation: Observe liquidity pools, cautiously set slippage tolerances, and divide large trades into smaller pots.

Impermanent Loss

- Risk: Losses are temporary providing liquidity in cross-chain pools that are mitigating during fluctuating losses.

- Mitigation: Know the potential risks of pools and, if possible, choose pairs with lower volatility.

Network Congestion and High Fees

- Risk: High gas fees and slow transactions during network congestion can negatively impact profits.

- Mitigation: Assess the network status and schedule transactions for less busy periods; cross-chain fee comparison.

Phishing and Scam Attacks

- Risk: Fake websites or malicious links can fraudulently obtain holders’ wallet info.

- Mitigation: Always check and verify common phishing attempts. Bookmark and trust certain sites. Seed phrases and private keys must never be shared.

Regulatory Risks

- Risk: Local DeFi access and service legality shifts by certain rules in your geographical area.

- Mitigation: Always comply and know one’s region’s laws. Use only compliant tools and platforms.

Pros & Cons

| Pros | Cons |

|---|---|

| Access to Multiple Blockchains – Users can utilize assets and opportunities across different networks. | Bridge Exploits Risk – Cross-chain bridges can be targeted by hackers. |

| Higher Liquidity and Yields – Multi-chain liquidity pools provide better rewards and investment options. | Smart Contract Vulnerabilities – DeFi protocols may have coding flaws that can be exploited. |

| Capital Efficiency – Assets can be leveraged across chains without selling them. | Impermanent Loss – Providing liquidity may result in temporary losses due to price fluctuations. |

| Interoperability – Seamless interaction between different blockchain ecosystems. | High Transaction Fees – Moving assets across chains may incur multiple network fees. |

| Diversification Opportunities – Users can spread investments across multiple chains to reduce risk. | Complexity for Beginners – Multi-chain operations can be confusing for new users. |

| Innovation Potential – Enables new DeFi products and multi-chain strategies. | Phishing and Scam Risk – Increased exposure to fake bridges or malicious platforms. |

Future of Cross-Chain DeFi

There is a bright future for Cross-Chain DeFi as blockchain interoperation gets better and better and more blockchains adopt the standard for easy communication. Users will be able to transfer their assets, liquidity, and data across numerous blockchains without any hurdles, unlocking a gateway for trading, lending, and yield farming.

Services like layer-2 solutions, decentralized bridges, and cross-chain oracles will mitigate costs, enhance transaction speeds, and bolster security, serving the needs for both retail and institutional users.

The growth of cross-chain DeFi will undoubtedly facilitate an increase in the complexity of cross-chain financial tools and products, cross-chain derivatives, multi-chain staking and aggregated yield farming.

Because cross-chain DeFi pivots on interoperability, it will be one of the first and most crucial components to be integrated into the DeFi ecosystem. Users of DeFi will be able to experience cross-chain financial and economic tools as well as a multi-chain capital system.

Conclusion

Cross-Chain DeFi is an innovative step in the development of decentralized finance. It lets individuals move freely across blockchain ecosystems, optimize liquidity, and diversify their financial options.

With a solid understanding of the fundamentals, abiding by the guidelines, and recognizing the possible hazards, users can safely bridge their assets, engage in yield farming, and implement multi-chain approaches.

The initial complexity of cross-chain technologies can be mitigated by starting to work with trustworthy services and keeping up with relevant information.

Increased interoperability makes Cross-Chain DeFi even more crucial in developing a versatile, streamlined, and interconnected financial ecosystem for all users.

FAQ

You can use a trusted cross-chain bridge like Multichain, cBridge, or AnySwap. Connect your wallet, select the source and destination chains, choose the token and amount, and confirm the transfer.

Multi-chain wallets like MetaMask, Trust Wallet, and Coinbase Wallet allow you to manage assets on different blockchains from a single interface.

Common risks include bridge hacks, smart contract vulnerabilities, impermanent loss, high transaction fees, and phishing attacks. Always use audited platforms and start with small amounts.

Yes, by participating in multi-chain liquidity pools, staking, or yield farming, you can earn rewards from different blockchain ecosystems simultaneously.