What Is LYO Credit(LYO)?

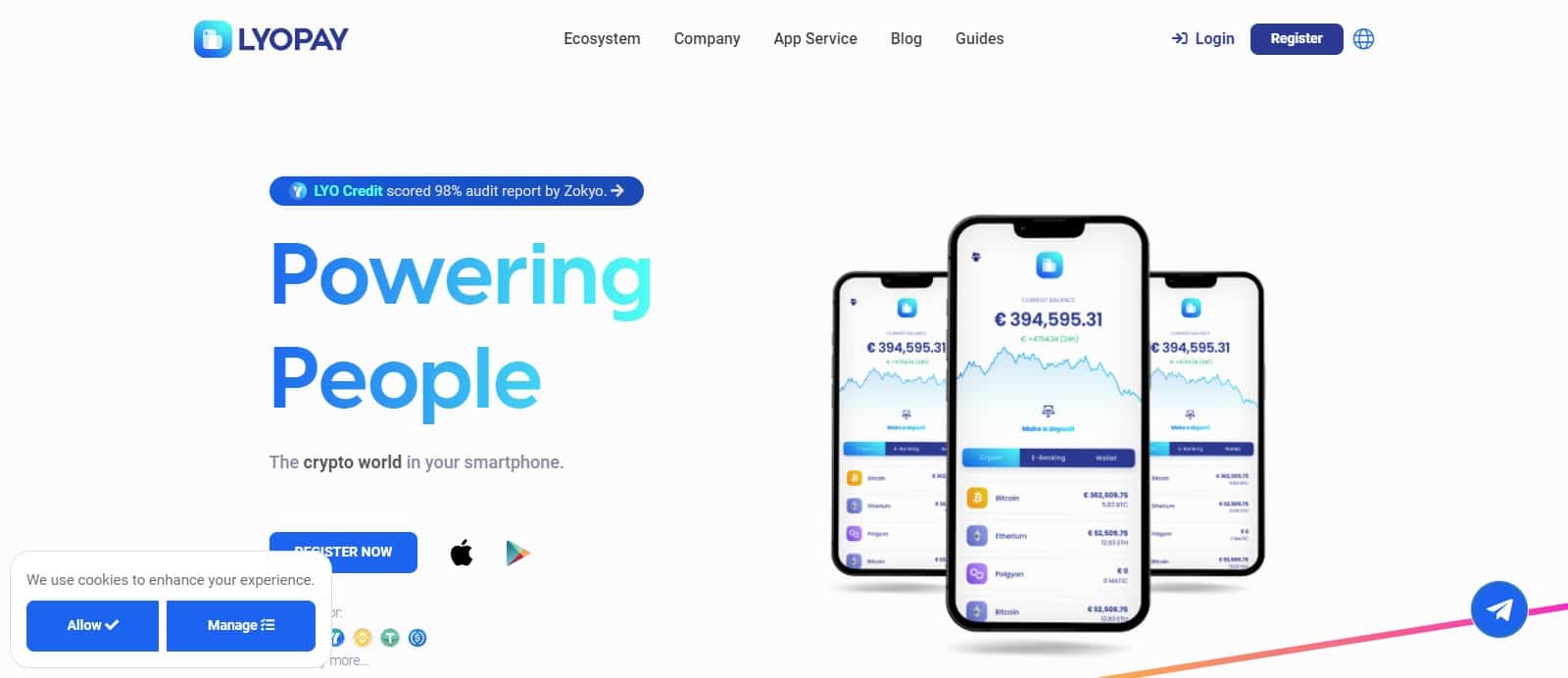

LYO Credit is a fintech organization managed by DIGILYO APP LTD, with the administrative office in Hong Kong and they have operational offices in more than 7 countries. You can access the ecosystem through more than 14 platforms that connect users to technological tools in an intuitive and simple way. These provide users with the ability to transact, store and use cryptocurrencies in a scalable way to promote your company ecosystem. LYOPAY aims to:

• Promote the mass adoption of cryptocurrencies

• Act as the bridge between the fiat and cryptocurrency worlds in a legal and safe manner

• Provide easy access for newcomers to cryptocurrency, all with just one complete Ecosystem

LYOPAY is an ecosystem that combines different services from many financial partners located in different countries, enabling faster global expansion in 14 different platforms. The main project is to build an ecosystem that encompasses primary payment services and extends to tools for professional trading, travel booking, a launchpad page and other services that will be expounded later in this document.

By incorporating several services also issued by third parties, LYO Credit falls into the category of an ecosystem. It is a new approach to an all-in-one experience ecosystem of services and tools, delivered via in-house technology and through third-party integration.

| Coin Basic | Information |

|---|---|

| Coin Name | LYO Credit |

| Short Name | LYO |

| Circulating Supply | 30,343,126.00 LYO |

| Max Supply | 250,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

An UAE based cryptocurrency.

Crypto – Payments

LYOPAY is a crypto payments app that expanded into an ecosystem of services dedicated to providing clients with the right tools that enable them to use cryptocurrencies on a daily basis. The technology behind each service in the ecosystem is designed to simplify cryptocurrency transactions for businesses and consumers.

Ecosystem

LYO Credit idea behind an ecosystem is to satisfy the need to connect consumers and retailers, enabling them to efficiently conduct transactions. In addition, they also offer a single account with multiple functions, so that a person can use the same ecosystem for most or all of these services. It is a strategy that companies have for the resources to expand into more fields.

KYC

LYOPAY operates in compliance with KYC, AML, and European General Data Protection compliance and regulations. Thanks to this, The operations take place in total transparency with respect to the institutions that regulate payment flows, and safety towards customers and their funds. The service providers that They relies on have the proper license to operate, as well as the partners who issue the products that will be available in the portal.

The purpose of LYO Credit is to create a token that fits into the ecosystem. LYO Credit tokens can be used to pay commissions and promote a community of users of the platform through currency rewards. LYO Credit (LYO) is based on the Binance Smart Chain protocol that is powered by Binance. The BEP-20 smart contract to facilitate transactions of the Ecosystem (LYO) and record balances of such credits in an account.

LYO Platforms

The idea of the project has always been to create a Super app, an application with which people can access a variety of services and features, with a single login. LYOPAY began its journey as a payment application, with the aim of aggregating services from other sectors, such as travel, tech device sales, trading, and much more. All of these functions will be accessible with a single sign-on (SSO) via LYOPAY. Single sign-on (SSO) is an authentication method that enables users to securely authenticate with multiple applications and websites by using just one set of credentials.

LYO Credit is more advantageous than systems for storing passwords in browsers. The password vaulting system is simply storing your credentials for all the different applications and inserting them when necessary. There is no trust relationship set up between the applications and the password vaulting system. With SSO, after the person logged in, they can access all company-approved applications and websites without having to log in again.

LYOPAY Services

Private customer services

LYO Credit services available as of mid-2021 are: e-bank account, exchange, crypto-wallets, plastic or virtual cards, token staking, and landing services in a single platform. There is one KYC used for identity verification for all services. In addition, a referral program will be available that allows users to reset their exchange costs. There will be the ability to earn up to three levels initially, and up to seven levels are planned for later development.

Corporate customer services

In addition to the services already available for individuals, business accounts will be able to activate the merchant service to receive payments from their customers. Businesses can integrate the service with a simple plug-in, without concern about transaction security, and having the ability to receive payments without daily limits.

B2B solution services

Today, building a high-level fintech platform can cost from 10 to 25 million dollars just for the technological, legal and infrastructure, as well as years to arrive at a product acceptable to the market. In July, LYOPAY will publish the BAAS platform service, wherein a company with a simple contract can obtain the entire ecosystem as a white-label product. This allows companies to promote themselves in the fintech market without having to invest time and money in development. LYOPAY provides the infrastructure, the companies add their marketing and branding, and the service is activated.

Leave a Reply