About Spectrum Finance Airdrop

Spectrum Finance Airdrop is a non-custodial decentralized exchange that allows a quick, effortless, and secure transfer of liquidity inside and between the Ergo and Cardano networks. The eUTXO model gives the unique possibility to have shared liquidity among different networks. Spectrum Finance will eventually feature a full AMM, Order Book and more.

Spectrum Finance is an open-source DeFi product which take a part in both Ergo and Cardano platforms and as a consequence exists for purposes of both communities. You can imagine.

| Basic | Details |

|---|---|

| Token Name | Spectrum Finance Airdrop |

| Platform | Own chain |

| Support | 24/7 |

| Total value | 999,999,999 SPF |

| KYC | KYC Is Not Requirement |

| Whitepaper | Click Here To View |

| Max. Participants | Unlimited |

| Collect Airdrop | Click Here To Collect Free Airdrop |

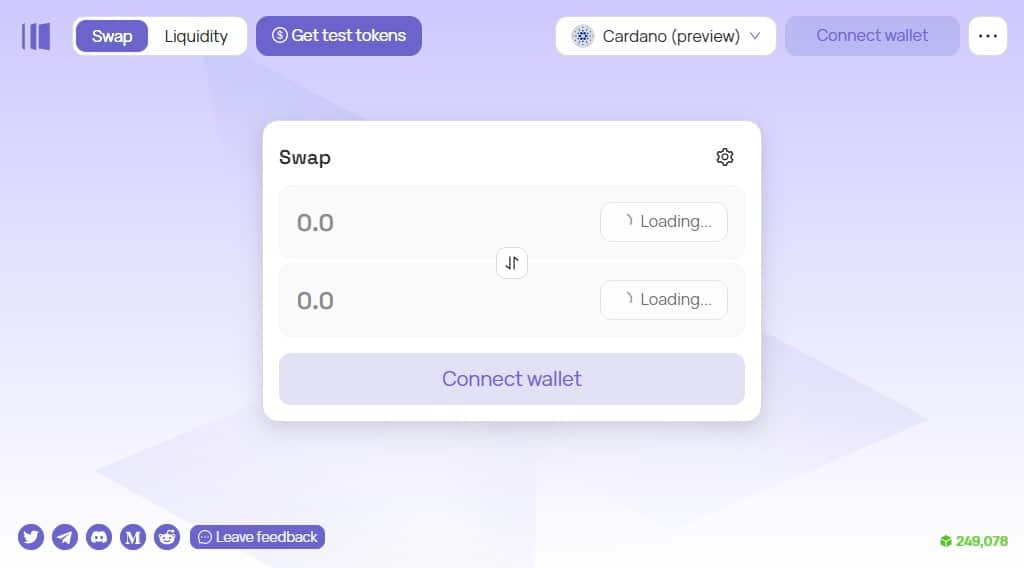

Step-by-Step Guide:

- Visit the Spectrum Finance testnet page.

- Connect your Cardano wallet.

- Change the network to testnet.

- Click on “Get testnet tokens” and get Cardano testnet token and Spectrum Finance testnet tokens.

- Now make swaps on the platform.

- Also provide liquidity to the platform.

- Early users who’ve done testnet actions will get free SPX tokens.

- For more information regarding the airdrop, see this tweet.

Automated Market Maker

An automated market maker (AMM) is a smart contract that holds liquidity reserves. Users can trade against these reserves at prices determined by a fixed formula. Anyone may contribute liquidity to these smart contracts, earning trading fees in return.

Orderbook

An order book system is similar to what you will see on traditional centralized exchanges. It shows buyers and sellers with amounts and the value of bids on one table.

Asset

A token which can be traded on the DEX.

Deposit

Used to deposit a token pair into the DEX to receive LP tokens and earn on protocol fees.

Redeem

An act of reclaiming liquidity which was provided to a liquidity pool earlier plus protocol fees.

Refund

Cancellation of an order which hasn’t been yet settled.

Constant Product Formula

The automated market-making algorithm used by Spectrum Finance, x*y=c. where x and y are deposits on tokens X and Y respectively and c is their product which has to remain constant after swap operations. CFMMs provide liquidity across the entire price range.

Liquidity

Digital assets that are stored in a pool contract and can be traded against by traders.

Liquidity Provider (LP)

A liquidity provider is someone who deposits tokens into a liquidity pool. Liquidity providers take on price risk and are compensated with trading fees.

Pair

A pool containing 2 tokens that are available to trade against each other.

UI Fee

Fees that the UI provider is rewarded with.

Miner Fees

Fees that are rewarded to miners for confirming the transactions.

Execution Fees

Fees that are charged for execution by the AMM bots.

Analytics

Spectrum Finance has a growing number of analytics available to show the user how productive a pool is. This will be added to frequently going forward, the purpose of this article is to explain the current analytics available.

TVL

TVL stands for Total Value Locked. This is an addition of all the funds locked in either the complete DEX, which can be seen up the top left of the homepage, or also in each pool. A higher TVL value is always going to be better. It will mean swaps have less chance of failing due to slippage tolerance as there is much more liquidity in the pool, meaning less volatility.

Volume 24H

Volume is a cumulative $value for all trades completed on the DEX over the span of 24 hours. It is shown as both the overall DEX volume, but you can also check specifically for each pool.

Fee Tier

This is the fee charged by each pool to make a transaction. It is set when the pool is created, these fee profits are paid in the asset received in the output of the transaction. These fees are what contribute to the liquidity pool to ensure liquidity providers are rewarded

Leave a Reply