About Teh Fund Coin

Teh Fund Coin is a decentralized protocol of cryptocurrency assets that are managed by the people. Teh Fund by Canis Ventures is an experimental V1 protocol (DAO) that Is trying to change how institutions /Wall Street invest into cryptocurrency assets. Teh fund uses a new business model that incorporates aspects of General Partners and Limited Partners along with the community micromanaging the crypto currency portfolio in an investment DAO.

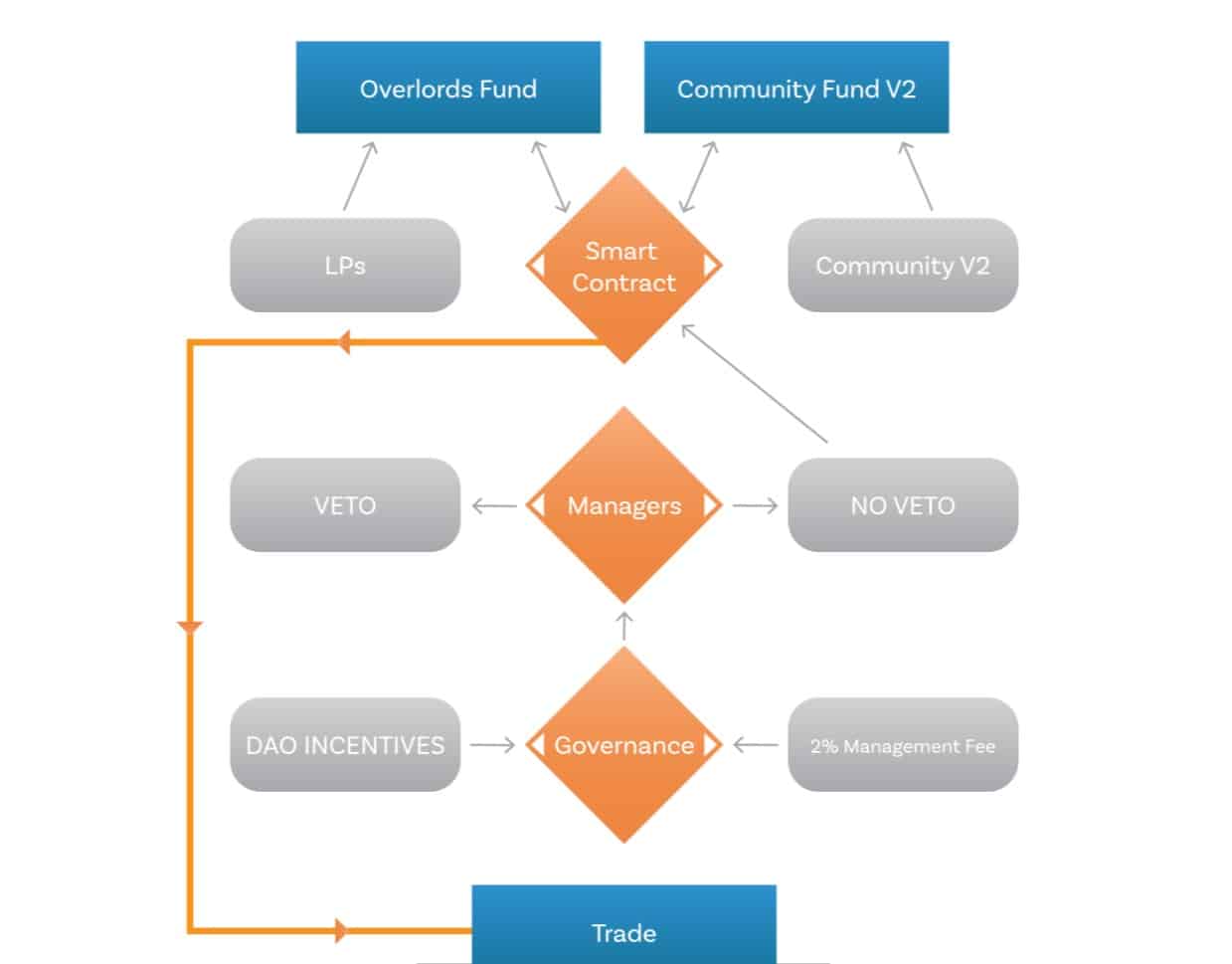

The people who stake FUND tokens in the DAO will manage the first installment of Overlords assets allocated to the DAO. Overlords assets are specifically tasked to invest in decentralized projects via DEX. Stakers will be able to do two things in the protocol.

Teh Fund Coin Point Table

| Coin Basic | Information |

|---|---|

| Coin Name | Teh Fund Coin |

| Short Name | FUND |

| Circulating Supply | N/A |

| Max Supply | 100,000,000 |

| Source Code | Click Here To View Source Code |

| Explorers | Click Here To View Explorers |

| Twitter Page | Click Here To Visit Twitter Group |

| Whitepaper | Click Here To View |

| Support | 24/7 |

| Official Project Website | Click Here To Visit Project Website |

How is Teh Fund different than other Investment DAOs?

Teh Fund Coin are three second generation versions of investment DAO. There is the DAO + FUND model, Syndicate model, and the service model. The first model is a traditional model like the first generation of investment DAOs. They raise funds via investors and use all DAO participants as voters on how to proceed. The second model uses DAO participants as individual managers of the funds and as a result, sub DAOs are created.

They use a delegation system and require more action for each investment madeby the DAO. The third model uses community to provide the services of the fund. Teh Fund has incorporated aspects of all three into its model, as a result, having legal compliance and adopting a intermodal for DAO token use. Teh Fund has batched assets together via LPs that was arranged by the GP. These LPs have come together in a decentralized manner to support the project.

Teh Fund Coin stakers are incharge of the assets in a decentralized manner, placing the assets where they choose for investment according to the smart contract parameters. The managers, community members, are acting as a service and thus get paid in management fees. This is why Teh Fund is considered an experimental investment DAO. It is the first of its kind.

DAO/Investment Market Problems

Just like traditional VCs, DAOs are also mostly centralized even though they are marketed as decentralized and they are raising funds in centralized manner. A few key holders control most of the voting power in governance of these DAOs. With Teh Fund DAO model, the voting system is different than other DAOs and the limitations are refined to prevent manipulation. Teh Fund Coin incorporates a two way staking system for the FUND governance token and policies. These two aspects allow for more users to benefit from the DAO.

Barriers of entry are a big problem for investors looking into this industry space. Teh Fund uses Web 3.0 technology for normal investor to connect their decentralized wallets to participate in the DAO. Using cryptocurrency to participate in investment DAO is a newer concept, but one that has already begun to take over traditional models.

Legal Compliance

Teh Fund V1 is a fully compliant DAO protocol that is not considered a security by the SEC. Almost all investment DAOs are considered securities because; The SEC makes clear that it views DAO-issued tokens as “securities” when (i) the tokens were issued in exchange for money, (ii) purchasers of the token expected the tokens to increase in value, and (iii) the value of the enterprise was linked to the managerial efforts of the founders running the DAO. These are the following3arguments to why Teh Fund is not considered a security;

- No DAO tokens were issued in exchange for money. All tokens are issued to the public or DAO participants. None of LPs were given tokens. If they wanted, they could buy from the open market.

- The two staked system and tokenomics allow for price appreciation. Upon public investors getting the token, there is no contract and therefor, no expectations or promised made by the team for profits. The value of the DAO token is purely market driven.

- The founders/creators of the project are not the managers. The public holders who vote, act in managerial efforts. Thus the value of the project is not made by the founders, but the public and their ability to manage capital in trades.

Vision

Teh Fund Coin manifesto is for Teh Fund V1 by Overlords and under the operative name of Canis Ventures. The vision is a plan put together by the people behind the Overlords that is for a true investment DAO. A placed where decentralized funds can be collected in smart contracts and managed in a decentralized manner by decentralized entities without fear of regulation and prosecution.

This manifesto requires like-minded people to come together to build. Devs need to create the backend. Others the front end. Peer review. Audits. Internal & open Beta. Alpha. Not open sourced to keep the competition at bay. Wait for V2 manifesto. Lets get the War Party started.

Why Choose Teh Fund Coin?

Ecosystem works

Its the first day the protocol goes live. Total capital in the smart contract is $1,500,000. Wallet owner 0x20 sends a proposal to the DAO for an investment into Decentraland (MANA) at the entry price of $0.40 with a total capital expenditure of $150,000. He stakes the amount needed to submit the proposal which is 1,000,000 FUND. Shortly after two other wallets holders, 0x33 and 0x21, join the voting proposal and each respectfully stake 500,000 FUND each in the trade proposal governance pool. The managers go ahead and do the NO VETO action.

The dashboard page of the DAO

- Show total value in USD of the Overlords Fund that needs to change in real time in relation to the trade values ongoing.

- Show total profits of the Fund with 7/30/90/max timeline options.

- Show proposed/active/closed trades with project name, current or closed profit percentages (show in accordance to date created).

- Show graphic of the total FUND staked in the governance/staking pools in comparison of the total circulating supply of 50,000,000 FUND.

- Show menu bar of Dashboard/Manifesto/Governance/Staking/Socials/Connect Wallet functions

Raise capital

Users can deploy more capital to the fund if they decide the Overlords Fund is performing well and they want profits (OR ANOTHER FUND CAN BE PROPOSED FOR THE DAO AND IT CAN RAISE MORE CAPITAL FOR THIS) Wait for V2.

Manager Function

Overlords has a veto/no veto function for every proposal to pass to the smart contract, if no veto option, then smart contract must execute trade once paraments armed. If veto, then there is no trade and all staked FUND tokens in the voting must be unstacked and the vote canceled.

Connect wallet

Metamask/Trust wallet connect, after connect can see FUND balances and their individual stats, use governance vote, stake/unstake option, claim.

Governance

In this portal, connected wallets can create trade proposals based on the following conditions.

Where Can You Buy Teh Fund Coin?

Tokens Can Be Purchased On Most Exchanges. One Choice To Trade Is On Uniswap (V2), As It Has The Highest FUND/WETH. e Trading Volume, $8,947 As Of February 2021. Next is OKEx, With A Trading Volume Of $6,180,82. Other option To Trade Include FUND/WETH And Huobi Global. Of Course, It Is Important To Note That Investing In Cryptocurrency Comes With A Risk, Just Like Any Other Investment Opportunity.

Market Screenshot

Teh Fund Coin Supported Wallet

Several Browser And Mobile App Based Wallets Support Teh Fund Coin. Here Is Example Of Wallet Which Teh Fund Coin – Trust Wallet For Hardware Ledger Nano.

Leave a Reply