In this article, I will cover the Top Bridging Aggregators for Polygon Network, and the way the Polygon Network Aggregators simplify cross-chain asset transfer.

The aggregators improve transfer speed and reduce transfer fees while maintaining smooth interoperability between Polygon and other major blockchains.

They provide users secure, efficient, low-fee, and hassle-free solutions across multiple Polygon bridged networks while aggregating multiple bridge and liquidity sources and maintaining minimal KYC compliance.

What is Bridging Aggregators?

Bridge aggregators streamline the movement of blockchain digital assets by simplifying the use of bridges to other blockchains with a defined liquidity source. It ensures optimal speed, utmost security and minimal cost for users.

It simplifies the use of bridges by analyzing many parameters, including gas cost, speed, and transaction dependability. They interoperate seamlessly with other chains like Ethereum, Polygon, and BNB Chain.

Furthermore, they enhance the level of usability by offering a user-friendly interface to minimize the blockchain failure ratio, thus offering a more efficient way of engaging with the blockchain. Bridging aggregators offer the best user experience by acting as intelligent routers for the decentralized transfer of assets.

How To Choose Top Bridging Aggregators for Polygon Network

Security & Audits – Select aggregators with the best audits and transparency, as well as proven security to mitigate the risk of hacks.

Transaction Speed – Delays greatly affect usability, so compare the time it takes to move assets on Polygon and on other chains.

Fee Structure – Select aggregators with the best routes to save on gas fees which are optimized for Polygon.

Liquidity Availability – Make sure the aggregator you select has enough liquidity to ensure smooth and seamless swaps.

Multi-Chain Support – Flexibility is better when the aggregators you choose connects Polygon with several chains.

User Experience – Efficiency is best when steps are minimized, making a system with a smooth and guided pathway preferred.

Reputation & Reviews – Community feedback on active users and partnerships and other aspects should be well assessed before choosing a third party.

Key Point & Top Bridging Aggregators for Polygon Network List

| Bridging Aggregator | Key Point Highlight |

|---|---|

| Defiway Bridge | Provides cross-chain transfers with a focus on speed and secure routing. |

| Across Protocol | Specializes in capital-efficient bridging with low slippage and fast finality. |

| Stargate Finance | Offers deep liquidity pools for seamless transfers across multiple blockchains. |

| Synapse Protocol | Supports cross-chain swaps with strong focus on scalability and interoperability. |

| Orbiter Finance | Optimized for fast and gas-efficient transfers to and from Layer 2 networks. |

| Hop Protocol | Enables quick, trustless asset transfers between Ethereum and Layer 2 solutions. |

| Meson Finance | Provides stablecoin-focused cross-chain transfers with minimal transaction costs. |

| Symbiosis Finance | Aggregates liquidity across chains, enabling smooth multi-token cross-chain swaps. |

| LI.FI Protocol | Acts as a meta-aggregator, combining multiple bridges and DEXs for best routes. |

| Jumper Exchange | User-friendly interface offering route comparison for fast and cost-effective swaps. |

1. Defiway Bridge

Defiway Bridge is one of the best bridging aggregators for the Polygon network because of its simplified approach towards speed, security and cost efficiency.

Unlike traditional single-route bridges, Defiway aggregates several pathways and assures users of the best optimized transaction routes.

Its unique strength is in its ability to reduce friction on cross-chain transfers, while maintaining consistent reliability, even during network congestion.

For users in Polygon, this translates to faster deposits, lower fees and more flexible unspent transaction output (UTXO) mobility across ecosystems.

The bridge’s minimalistic approach coupled to its strong infrastructure is why its so popular with traders and developers who want seamless Polygon integration.

| Feature | Details |

|---|---|

| Platform Name | Defiway Bridge |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche, and other major chains |

| KYC Requirement | Minimal / Not required for most transactions |

| Transaction Speed | Fast, optimized routing for low-latency transfers |

| Fees | Low gas fees due to route optimization |

| Liquidity | Aggregated from multiple sources for seamless transfers |

| Security | Audited smart contracts, reliable cross-chain protocols |

| User Interface | Simple, user-friendly, wallet-to-wallet transfers |

| Unique Advantage | Focused on efficient Polygon interoperability with minimal friction |

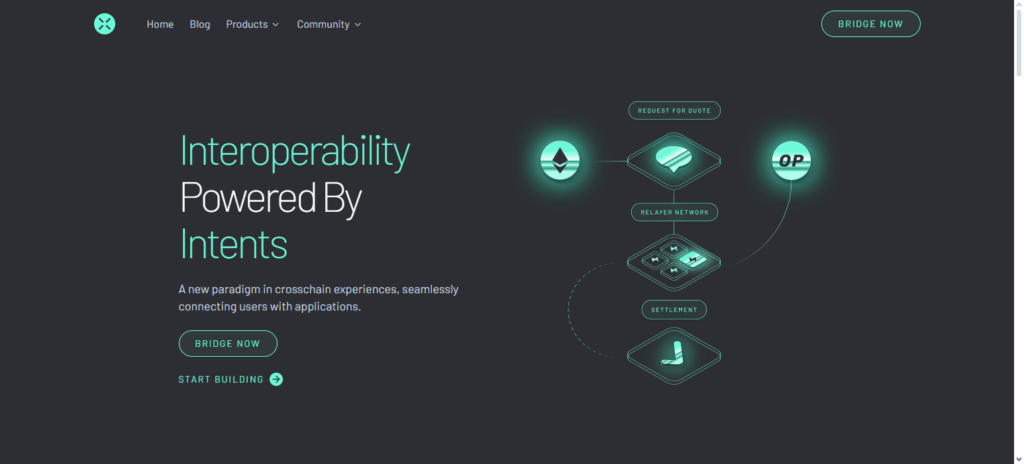

2. Across Protocol

Across Protocol is known as the leading bridging aggregator on the Polygon network because of its novel capital efficiency and instant transaction finality. Instead of using the traditional locked liquidity approach, Across uses a relayer-based system which minimizes slippage and accelerates transfers.

The design helps Across reduce bridging costs by employing optimal liquidity structures. This is a significant bridging fee savings for the user. For users on Polygon, this means instant, secure, and predictable transfers, without the tedious delays experienced on competing services.

Across Protocol’s Polygon bridging achieves superior balanced speed, low cost, and reliability, setting it apart from the competition.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Network Support | Polygon, Ethereum, Arbitrum, Optimism, Avalanche |

| KYC Requirement | Minimal / Not required for most standard transfers |

| Transaction Speed | Near-instant finality using relayer-based system |

| Fees | Low transaction costs due to capital-efficient design |

| Liquidity | Efficiently managed pools to minimize slippage |

| Security | Audited contracts with secure cross-chain protocols |

| User Interface | Simple and accessible for both beginners and advanced users |

| Unique Advantage | Capital-efficient bridging with low slippage and fast Polygon transfers |

3. Stargate Finance

Stargate Finance is among the best cross-chain aggregators for the Polygon network. Its unique liquidity model enables users to move assets across chains without fragmentation.

Contrary to conventional approaches to bridging liquidity which pours into fragmentation pools, Stargate adopts liquidity bifurcation which enables Polygon transactions to enjoy lower slippage liquidity pools.

Reducing slippage not only increases trustless transactions but also encourages inexpensive large-volume transfers.

Polygon users are guaranteed optimal speeds and utmost efficiency for lowered transaction failure. Stargate Finance is able to maintain liquidity depth across ecosystems which makes Polygon interoperability seamless.

| Feature | Details |

|---|---|

| Platform Name | Stargate Finance |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche, Arbitrum |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Fast transfers using shared liquidity pools |

| Fees | Low fees with reduced slippage due to deep liquidity |

| Liquidity | Unified liquidity pools across supported chains |

| Security | Audited smart contracts with high reliability |

| User Interface | Easy-to-use, supports direct asset transfers |

| Unique Advantage | Shared liquidity model ensures smooth, cost-efficient Polygon transfers |

4. Synapse Protocol

Synapse Protocol is one of the leading bridging aggregators of the Polygon network because of its attention to interoperability and scalable cross-chain communication.

Unlike most bridging services, it not only supports asset transfers, but cross-chain messaging as well, enabling Polygon to communicate with a diverse range of blockchains.

This versatility benefits end-users and developers looking for more advanced functionality than mere token bridging. As a result of its low fees, quick settlements, and secure framework, users can complete Polygon transactions with efficiency and reliability.

This is why Synapse Protocol is one of the leading Polygon aggregators and it uniquely functions as a liquidity provider and messaging bridge.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche, Fantom |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Fast cross-chain transfers with low latency |

| Fees | Competitive fees with low slippage |

| Liquidity | Aggregated across multiple chains for seamless transfers |

| Security | Audited smart contracts with secure cross-chain messaging |

| User Interface | User-friendly dashboard for token transfers and messaging |

| Unique Advantage | Supports both asset transfers and cross-chain messaging for Polygon users |

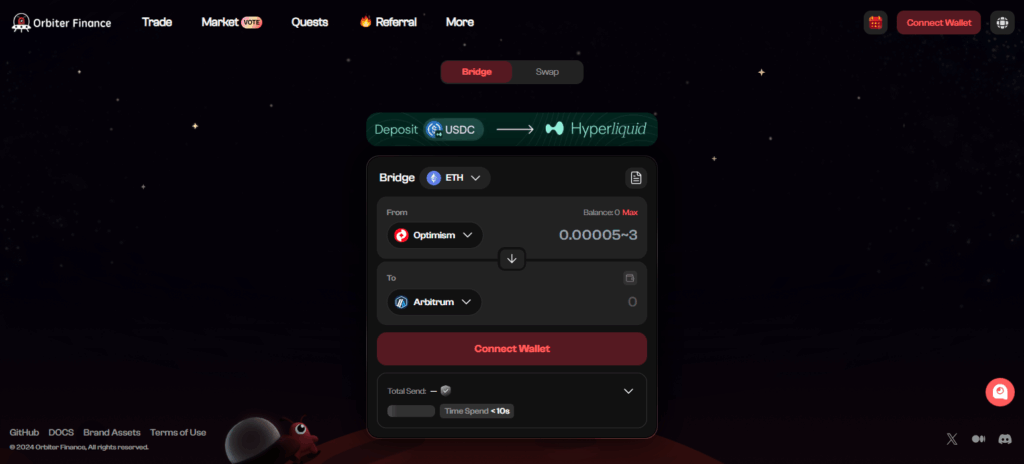

5. Orbiter Finance

Orbiter Finance achieves its competitive advantage as a bridging aggregator on the Polygon network through its fast and cost-effective transfers between Layer 2 and Polygon.

Its innovative design allows users to send assets directly and instantly from one wallet to another without intermediaries, thus avoiding unnecessary costs and intermediaries.

Polygon users enjoy fast and low cost transactions with gas, especially during peak network congestion.

Whereas most bridges are convoluted, Orbiter Finance is straightforward and easy to configure, streamlining the work of traders and casual users requiring seamless Polygon interconnectivity across various ecosystems.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Network Support | Polygon, Ethereum, Arbitrum, Optimism |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Near-instant transfers optimized for Layer 2 and Polygon |

| Fees | Low gas fees due to efficient routing |

| Liquidity | Aggregated from multiple sources for smooth cross-chain transfers |

| Security | Audited smart contracts with reliable cross-chain protocols |

| User Interface | Simple, wallet-to-wallet transfers |

| Unique Advantage | Optimized for fast, gas-efficient Layer 2 and Polygon interoperability |

6. Hop Protocol

Hop Protocol has great reputation in bridging Polygon to other network due to its trustless architecture which allows fast transfers of assets across Ethereum, Polygon, and other Layer 2 networks.

More importantly, it’s the first in the Polygon ecosystem to leverage AMM-based bonders enabling the near-instant transference of assets with no withdrawal delays. This makes Polygon users liquidity hungry as the withdrawal delays are absent.

There are no withdrawal delays with the Polygon network. This no withough delays policy eliminates withdrawal delays and ensures low transaction costs, creating the most efficient bridging Polygon Protocol. With low transaction costs and zero withdrawal delays, the Polygon Protocol is the best in the market.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Network Support | Polygon, Ethereum, Arbitrum, Optimism, Gnosis |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Near-instant transfers using bonders and AMMs |

| Fees | Low fees with fast settlement |

| Liquidity | Deep liquidity across multiple Layer 2 solutions |

| Security | Audited contracts ensuring trustless transfers |

| User Interface | User-friendly interface for quick bridging |

| Unique Advantage | Trustless, fast, and reliable Polygon cross-chain transfers |

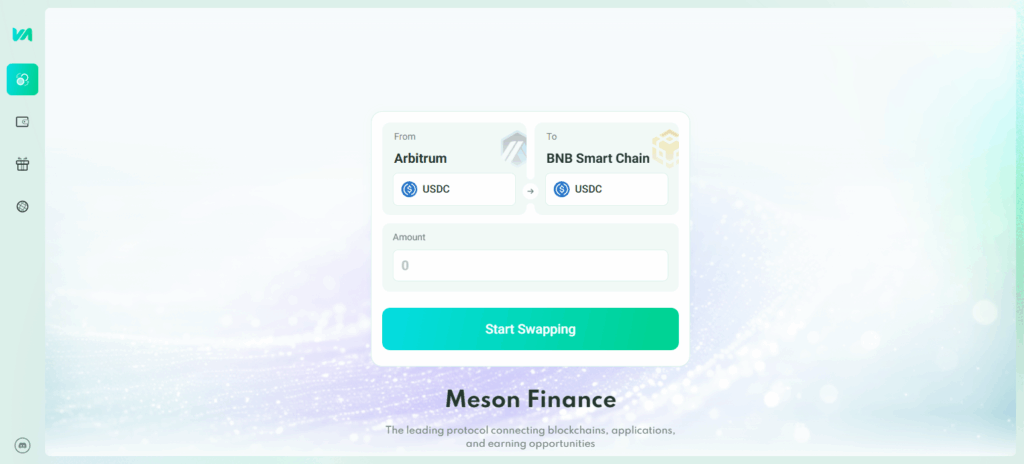

7. Meson Finance

Meson Finance shines as a leading bridging aggregator for the Polygon network due to its focus on stablecoin transfers with ultra-low fees.

While many bridges attempt to cater to various token types, Meson’s concentration on stablecoins makes it a go-to for traders and DeFi users who need reliable value during cross-chain transfers.

Even with the most congested periods on the network, Meson’s innovative routing structure guarantees optimial gas costs, fast transaction finality, and dependable network performance.

This means Polygon users benefit from fewer risks from liquidity volatility and lower network congestion. Meson Finance’s enhancements to the stablecoin bridging process further cements the platform’s reliability for Polygon users.

| Feature | Details |

|---|---|

| Platform Name | Meson Finance |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche |

| KYC Requirement | Minimal / Not required for standard stablecoin transfers |

| Transaction Speed | Fast, optimized for stablecoin transfers |

| Fees | Ultra-low fees for efficient cross-chain transfers |

| Liquidity | Stablecoin-focused pools for reliable transfers |

| Security | Audited smart contracts with secure bridging protocols |

| User Interface | Simple and easy-to-use interface for Polygon users |

| Unique Advantage | Specialized in cost-effective and predictable stablecoin bridging on Polygon |

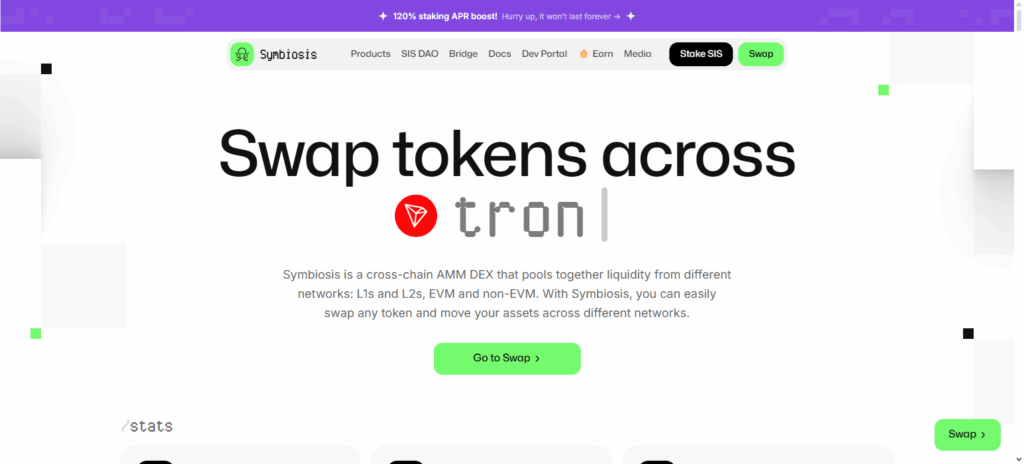

8. Symbiosis Finance

Symbiosis Finance is among the top bridging aggregators servicing the Polygon network because of its singular interface supporting swaps of multiple tokens across multiple chains.

Its competitive edge is in the consolidation of cross-chain liquidity with decentralized exchange capabilities: Polygon users can swap and transfer assets in a single step with no successive transactions. This approach minimizes transaction costs, slippage, and time, thus providing high operational efficiency for traders and developers alike.

Besides, Symbiosis emphasizes safety and smooth cross-chain interactions, delivering dependability, even during periods of high network congestion. Symbiosis Finance’s all-in-one bridging and swapping solution providing Polygon interoperability is unparalleled in the market.

| Feature | Details |

|---|---|

| Platform Name | Symbiosis Finance |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche, Fantom |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Fast, optimized for multi-token and multi-chain swaps |

| Fees | Low fees with reduced slippage |

| Liquidity | Aggregated liquidity across multiple chains for smooth transfers |

| Security | Audited smart contracts ensuring secure cross-chain swaps |

| User Interface | Intuitive interface for both bridging and swapping |

| Unique Advantage | Enables simultaneous multi-token swaps and bridging on Polygon |

9. LI.FI Protocol

LI.FI Protocol is a leading bridging aggregator on the Polygon network due to its meta-aggregator capability which consolidates multiple bridges and DEXes to offer the best cross-chain paths.

Its core strength is the ability to identify and route a transaction along the most vias and economical path without compromising on the security of the transaction.

This automatic transaction routing capability is beneficial for users as they do not have to engage in route planning and cost estimation. For Polygon, this results in improvement in asset transfer along with a decrease in gas fees and chance of transaction failures.

Furthermore, LI.FI has increased its range of supported tokens and chains. This added interoperability comes without the cost of sacrificing security, making LI.FI Protocol the most cost-effective and reliable bridging solution on Polygon.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Fast transfers using optimized routing across multiple bridges |

| Fees | Low fees due to meta-aggregation and best-route selection |

| Liquidity | Aggregated across multiple bridges and DEXs for seamless transfers |

| Security | Audited smart contracts with secure cross-chain protocols |

| User Interface | User-friendly interface with automatic route optimization |

| Unique Advantage | Meta-aggregator combining multiple bridges for fastest, cheapest Polygon transfers |

10. Jumper Exchange

Jumper Exchange is a premier bridging aggregator for the Polygon network because of its intelligent routing system and interface which guarantees rapid and inexpensive cross-chain transfers.

Its most distinguishing characteristic is the ability to compare multiple bridging paths and automatically select the least expensive and quickest confirming route.

Polygon users enjoy effortless asset transfers because jumpr exchange reduces gas prices with its low- latency transaction arrangements.

In addition to ease of use, Jumper exchange supports a wide range of tokens which adds to its versatility for traders and developers. Due to its optimal gas prices and rapid cross-chain transfers, Jumper exchange stands out as a premier bridging solution for the Polygon network.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange |

| Network Support | Polygon, Ethereum, BNB Chain, Avalanche |

| KYC Requirement | Minimal / Not required for standard transfers |

| Transaction Speed | Fast transfers with real-time route comparison |

| Fees | Low fees with optimized routing |

| Liquidity | Aggregated from multiple sources for smooth cross-chain swaps |

| Security | Audited smart contracts with reliable bridging protocols |

| User Interface | Intuitive interface allowing easy route selection |

| Unique Advantage | Real-time comparison of bridging paths for fastest and cheapest Polygon transfers |

Pros & Cons Top Bridging Aggregators for Polygon Network

Pros:

- Faster Transactions – These methods shorten the time spent on any investment by optimizing routes.

- Lower Fees – Automated Systems line the least expensive routes.

- Minimal KYC – KYC verification processes on most of the platforms is quite basic.

- Improved Liquidity – Less slippage allows for smoother and larger transfers aggregates liquidity.

- Multi-Chain Support – Transfers with other major networks and Polygon are seamless.

- User-Friendly Interfaces – Even more so with the alleviation of complex functions, bridging is simplified for both novices and professionals.

- Enhanced Security – The chances of a transaction failing or getting compromised are diminished due to the auditing of smart contracts.

Cons:

- Smart Contract Risk – The lack of protection on contract piracy makes contracts on smart aggregators contracts highly vulnerable.

- Network Congestion – Slippage is possible for transfers during busy periods.

- Limited Token Support – Generic functionalities are available for a few select tokens.

- Complex for Beginners – The advanced features like route selection can be overly intricate for those who lack basic understanding.

- Potential Fee Fluctuations – Gas fee volatility is related to slippage on the network.

Conclusion

To sum up, the leading bridging aggregators for the Polygon blockchain ecosystem are instrumental for quick, secured, and economical cross-chain transfers of different digital assets.

Providing Polygon users with smooth cross-chain connectivity, Defiway Bridge, Across Protocol, Stargate Finance, and other platforms add value by aggregating liquidity, optimizing transaction paths, and minimizing costs.

These aggregators are accessible due to KYC-lite and easy-to-navigate interfaces. Aggregator users must, however, exercise caution with smart contract vulnerabilities and the risk of congestion due to network overload.

Overall, the Polygon ecosystem’s utility and adoption is strengthened by these aggregators, providing traders, developers, and DeFi users the ability to transfer assets with improved efficiency.

FAQ

Most top Polygon bridging aggregators require minimal or no KYC for standard transactions, allowing quick access to cross-chain transfers.

Support varies by platform, but popular stablecoins, Ethereum-based tokens, and Polygon-native assets are typically supported.

Yes, reputable platforms use audited smart contracts, but users should always be aware of smart contract and network risks.

Fees depend on gas costs and liquidity routing. Aggregators optimize paths to reduce costs wherever possible.

Yes, many aggregators, like LI.FI Protocol, act as meta-aggregators, automatically selecting the fastest and cheapest bridging routes.