In this article, I will discuss what comes next after Bitcoin and Cryptocurrency. Although Bitcoin and other digital currencies transformed finance, the digital asset space continues to evolve.

From Central Bank Digital Currencies (CBDCs) and stablecoins to tokenized assets, Web3 technologies, and decentralized finance, emerging trends are likely to reshape the future of money.

Overview

Over the past decade, Bitcoin and its fellow cryptocurrencies have transformed our understanding of money and finance, ushering in the era of multi-currency and decentralized finance.

Bitcoin was released in 2009, and while once it was a niche digital ‘thing’, its popularity rose enough to earn it fame, also spawning a multitude of alternative cryptocurrencies.

Now, it is unanswered as to what is Bitcoin and cryptocurrency’s successor. Upcoming trends would benefit investors, technology lovers, and even ordinary people in predicting what is to come.

What Comes Next After Bitcoin and Cryptocurrency?

What is Bitcoin and Cryptocurrency?

Bitcoin, stemming from 2009, was the first successful attempt at a decentralized form of digital currency. It enables transactions between two parties without the need for banks or any other intermediaries. It still preserves the anonymity of the users.

Blockchain-based cryptocurrencies have transcended the bounds of Bitcoin, creating over a thousand fanciful digital assets. Each asset plays a different role, from smart contracts, digital collectibles, to decentralized finance (DeFi). They bring substantial innovation to the finance, investment, or payments infrastructures and flows globally.

The Evolution of Cryptocurrencies

Bitcoin was the first to create a form of decentralized digital currency, utilizing blockchain technology to maintain the digital coins’ transparency and security. Other coins like Eth, Cardano, and Solana entered the market after, providing smart contracts, speedy transaction methods, and modernized functions.

Over time, the crypto market expanded beyond just speculative trading. The DeFi (decentralized finance) platform, for example, enables users to lend, borrow, or trade without needing access to a bank, demonstrating the use of crypto for practical finance and the shift from pure investment.

The expansion of cryptocurrency also proves that people’s mindset is changing towards crypto. The use of digital currency was initially viewed as a high-risk gamble, but it has recently become more integrated into the primary finance market.

The large companies that are starting to accept cryptocurrency for payment and the inflow of capital into the market from institutional investors prove that digital assets are not just a temporary trend.

Emerging Digital Assets Beyond Cryptocurrency

Besides the standard cryptocurrencies, the world of emerging digital assets is altering the financial landscape in real time. Digital money of the Central Bank (CBDC) is digital money issued by the government to enhance the efficacy of payments while streamlining financial surveillance.

Stablecoins, which are tied to fiat currencies, embrace the world of blockchain while preserving price stability which makes them ideal for payments and trading. Moreover, the tokenization of real-world assets, like real estate, stocks, or artworks, enables easier value transfer and fractional ownership. All these innovations broaden the horizon of blockchain technology and embrace a diverse and expansive economy.

Web3 and Decentralized Technologies

Web3 is the next stage of the internet, giving users control over their data, identity, and interactions online. Web3 is built on Blockchain technology, which enables the creation of decentralized apps (dApps) that run autonomously.

Web3 integrates Non-Fungible Tokens (NFTs,) which permit singular ownership of select digital items like art, music, real estate, and virtual collectibles. While still seen as a phenomenon of art and gaming, NFTs are yet to reveal their ability in real estate, intellectual property, and supply chain management.

The Decentralized Autonomous Organization systems are another example of the future of community rule. Both systems allow users to vote on issues, which in turn reduces the need for upper management. These structures push the idea of a world where finance, governance, and digital communities are decentralized, operating in a safe, transparent, and effective manner.

Integration with Traditional Finance

Another emerging trend is the integration of traditional payment methods with the Blockchain payment system.

In this strategy, many advantages, such as decreased overheads and more efficient settlement timelines, shall also help in cross-border payments. Entering the Blockchain and crypto market helps gain more legitimacy for digital currencies.

Adoption of digital wallets and payment methods integrated with crypto, along with the support provided by merchants, facilitates the widespread mainstream use of crypto. Thus people are developing more interest in the payment systems, digital wallets, and virtual debit cards.

Regulatory and Security Considerations

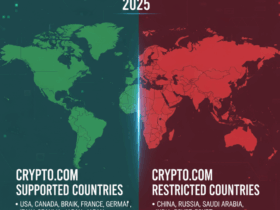

As digital assets continually change, regulatory and security issues become more critical than ever. Globally, governments are attempting to establish regulations for cryptocurrencies, CBDCs, and blockchain technology to encourage innovation while preventing fraud, money laundering, and tax evasion.

Meanwhile, security remains a primary concern, as users and platforms are susceptible to cyberattacks, hacks, and scams. Privacy-focused cryptocurrencies and other advanced security measures aim to safeguard data and transactions. To create a digital finance system that is innovative, secure, and reliable, there needs to be a balance between regulation and innovation.

Predictions for the Future

The future of digital finance is only predicted to grow in speed of innovation and adoption. Various layer 2 solutions such as Bitcoin’s lightning network and Ethereum rollups on sidechains are focused on mitigating transaction speed and costs.

The fusion of AI and blockchain will improve automation in finance and also strengthen predictive analytics and risk management. Asset tokenization and the rise of networked digital economies will also transform concepts of ownership, commerce, and investments.

The convergence of CBDCs and decentralization will also emerge in the form of hybrid systems, improving the entire financial ecosystem and making it more open, secure, and efficient for individuals and institutions.

Conclusion

Bitcoin and cryptocurrencies have transformed finance through innovations in digital money and decentralization. The future extends beyond regular cryptocurrencies to include CBDCs, stablecoins, tokenized assets, and Web3 technologies like NFTs and DAOs.

The innovations within these technologies may provide a more improved, transparent, and inclusive financial ecosystem of the world, despite the challenges of regulation, security, and adoption. Understanding these trends will be a necessity for anyone post-Bitcoin, including investors and institutions.

FAQ

Blockchain will enable faster payments, secure digital ownership, decentralized finance (DeFi), and more transparent governance systems, transforming finance, commerce, and online interactions.

Regulations aim to ensure security, prevent fraud, and encourage innovation, creating a safer and more sustainable digital financial ecosystem.

Key technologies include Web3, NFTs, DAOs, layer-2 blockchain solutions, AI integration, and hybrid systems combining CBDCs with decentralized networks.