In this article, I will discuss the How To Do Cross-Chain Token Swaps, which represent an advanced method for users to move tokens between different blockchain networks with ease.

This method is becoming increasingly important for technology as the crypto ecosystem advances and requires improving interoperatability and flexibility.

Knowing about cross-chain swaps, regardless if you are a trader or a DeFi user, will enable you to be in control of your assets in a more streamlined and secure way.

What is Cross-Chain Token Swaps?

Cross-chain token swaps enable users to exchange different cryptocurrencies between distinct blockchain networks without needing to use centralized exchanges.

Unlike traditional swaps that occur within a single blockchain, cross-chain swaps allow for interaction between chains such as Ethereum, Binance Smart Chain, and Solana.

This process securely uses cross-chain bridges or particular decentralized exchanges (DEXs) to facilitate the transfer. It grants further control and flexibility over assets to users, thus decentralizing finance (DeFi) and making it easier to interlink different ecosystems.

How To Do Cross-Chain Token Swaps Step-by-Step

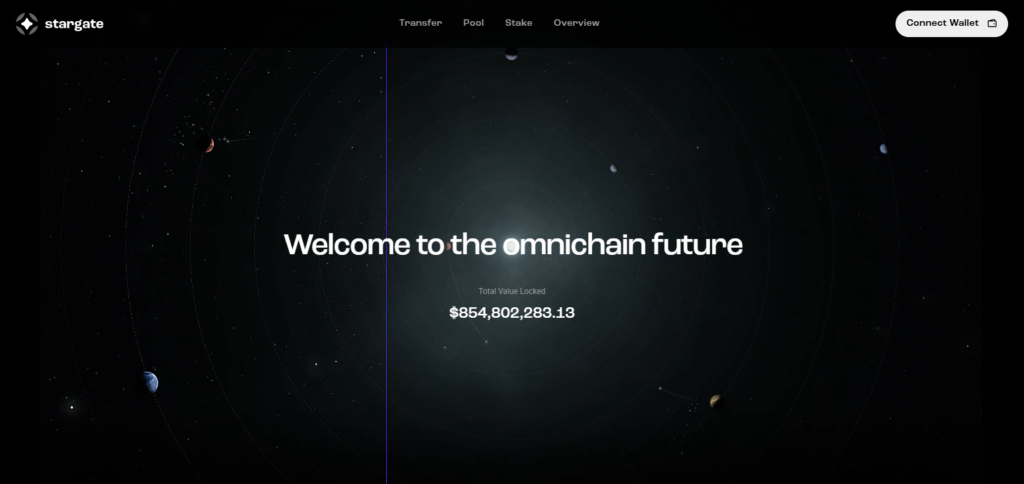

Here’s an example on cross-chain token swaps using Stargate Finance:

Visit Stargate Finance

Navigate to Stargate Finance and load up the first page.

Connect Your Wallet

Hit “Connect Your Wallet” then select your Ethereum based wallet, such as MetaMask.

Select Source and Destination Chains

Specify the Token you are swapping from blockchain (For Example: Ethereum) and the blockchains you want to send to, which can be Binance Smart Chain.

Choose the Token

Based on your selection from the previous step, Choose the token (USDT, USDC or even native tokens).

Enter the Amount

Provide the token amount you would like to swap.

Approve the Token

To Allow the Stargate Finance Swapping platform access fore tokens, approve it on your wallet.

Confirm the Swap

Ensure that the fees are correct then proceed to approve the transaction.

Wait for Completion

A notifications once the account has received funds will be given however it may take few minutes before receiving bank notification.

Switch the the destination network

You can view swapped tokens if you switch to the blockchain of your preferred destination value.

Verify your balance

Ensure the swap fuels has been completed by checking on your wallet.

Top Cross-Chain Token Swaps

Symbiosis

Symbiosis is a unique decentralized protocol built for cross-chain token swapping, allowing users to transfer assets with different blockchains in a single transaction.

It’s the eleventh-hour ability to aggregate liquidity from differnt networks that set Symbiosis apart. It does not require users to switch networks manually which differentiates it further from traditional bridges.

Manual network switching is no longer needed. Users are served with a single unified interface and real-time automated cross-chain token swaps.

RocketX

RocketX offers a hybrid cross-chain swap aggregator which combines the benefits of centralized and decentralized exchanges to provide smooth token swapping across various blockchains.

One of its key features is instantaneous price checks CEXs and DEXs, assuring that users get the most favorable prices.

For seamless cross-chain trading, RocketX does not require users to connect multiple wallets or manage manual bridging, making cross-network asset swaps efficient, secure, and hassle-free for the user.

Cross-Chain Token Swaps Worth it ?

Cross-chain token swaps provide value for users looking for more flexibility and the ability to access different blockchain ecosystems where assets can be transferred without the need for centralized exchanges.

They streamline time, reduce costs on certain occasions, and improve portfolio management across networks. Although there are some risks, using well-known platforms and adhering to security protocols makes cross-chain swaps an intelligent, effortless resource amid the shifting landscape of DeFi.

Common Mistakes to Avoid

Selection of the Wrong Network: Selecting the wrong blockchain may cause funds to be lost permanently.

Unsupported Tokens: Attempting to swap tokens that a DEX or bridge does not support will most likely fail.

Failure to Set Slippage Parameters: Not changing slippage settings will result in failed trades or trades that will not be profitable.

No Consideration of Gas Costs: Excessive gas costs can adversely affect the value of the token swap.

Hastening the Activity: Not verifying the wallet address or token pair may lead to mistakes.

Risk & Security Tips

Use Trusted Platforms

Only use bridges or DEXs that have their smart contracts audited.

Verify URLs

Never trust an address, and make sure to verify it on other platforms to avoid falling into a phishing trap.

Consider Your Wallet Security

Implement strong security protocols for hot wallets.a

Confirm Token Support

Done before checking which tokens may be swapped.

Avoid Mysterious Projects

New or unevaluated platforms and tokens should be treated with extreme caution.

Watch Out For Gas Fees

Attention should be paid to these fees as they can make or break the deal.

Future of Cross-Chain Technology

Increased Interoperability: Blockchains will be able to communicate with each other more smoothly with protocols like Cosmos IBC and Polkadot.

Faster & Cheaper Transactions: Improvements in bridging technology will make transactions fasterand cheaper.

Better User Experience: Network-agnostic swaps will grow in popularity.

Enhanced Security Models: The risk of bridging will be reduced by more secure mechanisms and well-audited smart contracts.

Broader Ecosystem Integration: DeFi, NFTs, and dApps will be able to operate across multiple chains seamlessly.

Pros & Cons

Pros :

Interoperability: Permits the movement of assets within different blockchains.

Decentralization: Bypasses the need for centralized exchanges.

Better Access: grants the utilization of DeFi tools on multiple chains.

Time-Efficient: More efficient than manual transfers of assets between chains.

Cost-Saving: Can save costs while using optimized routes.

Cons :

Security Risks: Smart contract or bridge exploits are highly vulnerable.

Technological Alienation: Advanced technology may be confusing to other users.

High Gas Rates: Certain chains can have high gas fees.

Lack of Token Support: Not all tokens and chains are applicable.

Transient Congestion: Users can experience transactions stalling due to congestion.

Conclusion

To wrap up, the DeFi space is experiencing more flexibility, ease of access, and efficiency with cross-chain token swaps that are transforming the user experience on multiple blockchains by enabling effortless asset transfers independent of centralized systems.

There are risks involved, but using reputable tools and adhering to security measures mitigates challenges. As technology progresses, these swaps will be critical for the development of cross chains in the blockchain network.