This article explores the Best Crypto Staking Platforms for Stablecoins while focusing on passive income streams with less volatility.

Stablecoins like USDT, USDC, and DAI Let investors reward while still preserving capital. We review the best platforms for stablecoin holders with the highest APYs, flexible earning options, and dependable security.

What is Crypto Staking Platforms?

Crypto staking platforms are services that allow users to lock up their cryptocurrencies to assist with a specific blockchain network’s operations and security. Users earn rewards for staking their coins.

This is more simpler compared to banks which pay interests for deposits. Most of these platforms take away the complications by performing required staking procedures like running nodes and validating transactions.

Many of them are multi-crypto supportive and of different profit-forms with easy-to-use panels for monitoring.

In summary, these systems are essential to the investors to have a crypto network as passive income and to receive a steady crypto staking platform which rewards staking.

Why Use Crypto Staking Platforms for Stablecoins

Low Risk, Steady Earnings – As stablecoins lack volatility, users earn predictable rewards with no wide gaps on price changes.

Passive Income Opportunity – Returning rewards on staked coins is a great way to put coins to use rather than leaving them idle in a wallet or exchange.

Better Rates Than Banks – Savings accounts earn very low interest compared to the yields offered on stablecoin staking which is a much better investment.

Secure and Easy to Use – The Beginner can safely perform complex staking operations with the automated services provided by these platforms

Liquidity Options – The flexibility offered during the staking process is unmatched as these services permit funds to be withdrawn at will.

Diversification – Stablecoin staking and Diversification can be used to develop complex investment strategies.

Supports Blockchain Ecosystem – Staked coins can help secure a network and improve efficiency with no volatility exposure.

Key Point & Best Crypto Staking Platforms for Stablecoins List

| Platform | Key Point / Strength |

|---|---|

| Binance Earn | Wide range of stablecoin staking options with flexible and locked terms |

| OKX Earn | Competitive yields with automated staking and DeFi integration |

| Nexo | Daily payouts and insured custodial services for secure passive income |

| YouHodler | High APYs with features like Dual Asset and Turbocharge leverage |

| Kraken | Strong security reputation and transparent reward distribution |

| Coinbase | Very easy to use and regulated in major markets; lower but reliable yields |

| Crypto.com Earn | High reward tiers, especially for users staking CRO tokens |

| Curve Finance | Best for stablecoin liquidity providers with low-risk DeFi rewards |

| Aave | Allows lending stablecoins for steady yield through decentralized protocol |

1. Binance Earn

Binance Earn is regarded as the best crypto staking platform for stablecoins. Offering the most comprehensive environments to Users for earning high interest securely.

It supports stablecoins like USDT, USDC, BUSD and offers earning features like flexible savings, locked staking and DeFi yield. What makes Binance Earn unique is its high security, great liquidity, and a highly intuitive earning interface.

It is great for earners at all levels, whether beginner, intermediate, or advanced. Users betting high with stake liquidity are guaranteed to earn high stablecoins interest. Earners of all levels see staked interest accrue in real-time.

Binance Earn maintains a global trust reputation, helping users earn passive income, and lowering earning APYs risk.

Binance Earn – Features

- Flexible savings, locked staking, and DeFi products for optimal returns

- Variety of supported stablecoins, including USDT and USDC

- Global exchange with reliable security and rapid reward tracking

2. OKX Earn

OKX Earn has great features that include ease of use, excellent earnings, and smart automation are part of a single ecosystem making it one of the best crypto staking platforms for stablecoins.

It offers a variety of stablecoins and flexible and fixed earning products which help users strike the best balance between liquidity and yield. OKX Earn has the advantage of merging extensive automation and access to DeFi behind the scenes to earn high APYs and utilize DeFi without a deep understanding of it.

The platform provides risk information, reward transparency, and easy withdrawal which add great convenience. OKX Earn provides the ability to stake stablecoins efficiently and securely. It earned a great reputation for high standards of global crypto security.

OKX Earn – Features

- Automated earning tools for stablecoin reward optimization

- Modified earnings for every income preference with flexible and fixed-term options

- DeFi integrations hassle-free and no technical knowledge required

3. Nexo

Nexo is highly regarded among platforms for staking stablecoins as it guarantees secure staking with stable earnings due to its robust financial structure.

Users can stake USDT, USDC, and DAI stablecoins and receive daily interest payments which can be compounded as they are automatically added to the stake.

Nexo’s distinguishing feature is its insured custodial accounts and adherence to the highest levels of compliance, which gives passive income earners peace of mind.

Moreover, Nexo has flexible terms, the ability to instantly and penalty-free withdraw your stake, and offers higher rates to loyalty tier users. Considering Nexo’s prioritization of security, professional asset management, and customer service, it is the best option for risk-averse staking in stablecoins.

Nexo – Features

- Automatic daily payouts and compounding with no user initiation required

- Insured custody and adherence to recognized financial standards

- No lock-ups or penalties, and instant withdrawals

4. YouHodler

YouHodler is regarded as one of the finest crypto staking platforms for stablecoins due to its high-yield earning opportunities combined with innovative financial instruments designed to optimize user returns.

It is compatible with major stablecoins such as USDT, USDC, and TUSD and sends users rewards every week for consistent income growth. YouHodler’s outstanding customer service, instant liquidity, and focus on user fund control, with no extended lock-up balances, also contribute to its reputation.

Strong APYs, advanced earning strategies, and custodial cryptocurrency storage under supervision make YouHodler an exceptional alternative for stablecoin holders wanting to maximize their passive income.

YouHodler – Features

- Major stablecoins for yields and highest APYs

- Creative earning products such as Multi HODL and Turbocharge

- Quick liquidity without long-term staking or commitments

5. Kraken

Kraken is considered one of the best crypto staking platforms for stablecoins due to its safety, transparency, and respectful attention to regulations. With Kraken, stablecoin holders can stake and earn returns on USDT and USDC, and also enjoy dependable transfer and receipt of returns on their staked USDC.

Kraken’s custody and risk management practices are highly reputable in the industry, and that gives stakers considerable confidence while staking.

Equity and simplicity of the Kraken platform are also helpful, especially for novice stakers. Easy access to staked cash, no surprises in charging staked cash, and high regard as a crypto player makes Kraken a remarkable stablecoin staking platform.

Kraken – Features

- A long history of safe staking and transparent risk management

- User-friendly interface for beginners to easily stake their stablecoins.

- No hidden Fees and flexible staking with reward payouts

6. Coinbase

Coinbase is widely recognized as one of the best crypto staking platforms because of its regulatory compliance and easy staking experience. Coinbase allows its USDC holders the opportunity to earn predictable returns and provide complete access to a user-friendly dashboard to manage and track earnings.

Coinbase’s one of a kind regulatory coverage in the world and institutions-grade security of crypto and cash custody vaults protect the user’s assets. Coinbase requires no technical knowledge which serves as a perfect platform for those seeking easy passive income.

Coinbase also provides a guarantee through its global recognition which, along with rapid reward distribution, reliable liquidity as well as a trusted global reputation, Coinbase is an excellent choice for crypto staking.

Coinbase

- Platform is Highly regulated and reputable which is helpful when it comes to earning stablecoins

- Earning cryptocurrency is very user friendly and easy

- You earn rewards automatically and have control over your staked funds

7. Crypto.com Earn

Crypto.com Earn is recognized as one of the best crypto staking platforms for stablecoins because it offers some of the most rewarding earning tiers in the industry, especially for users who stake CRO tokens.

It supports a wide range of stablecoins, including USDT, USDC, and TUSD, with flexible and locked-term staking options tailored to different income goals. The platform’s standout features is its tier-based system which lets committed users access higher APYs with custodial crypto protection and a premium mobile app experience.

Predictable reward payouts, a strong brand, and quick access to funds make Crypto.com Earn a solid option for passive income through stablecoin staking.

Crypto.com Earn – Features

- Tier-based earnings with higher APYs for CRO-stakers.

- Support for multiple stablecoins with staking terms and earnings range.

- Easily manage your earnings on the go with the seamless mobile app.

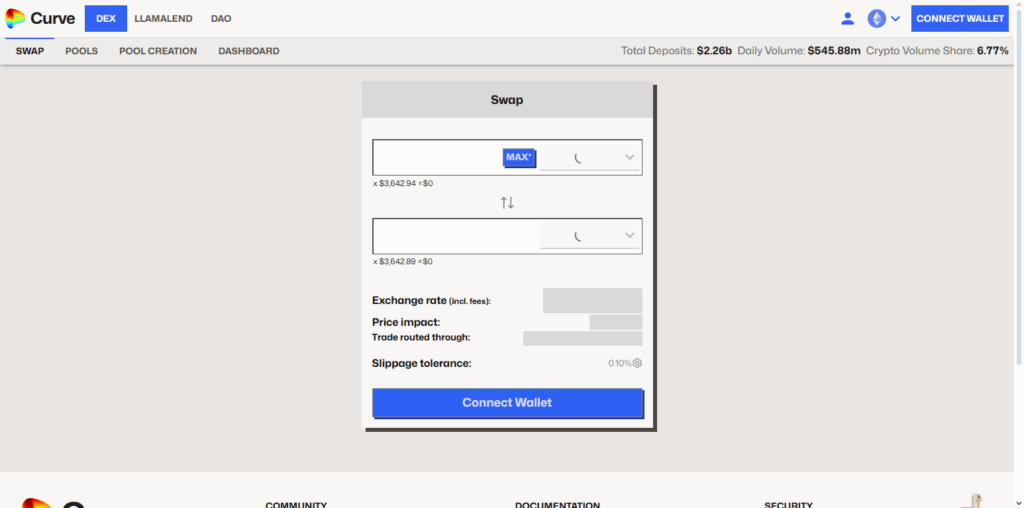

8. Curve Finance

Curve Finance tops the lists of best crypto staking platforms for stablecoins since it focuses on low-slippage stablecoins earning efficient and strong sustainable yields.

Rather than staking in the traditional sense, Curve users earn rewards by adding stablecoins like USDT, USDC, and DAI into Curve pools, then earning bonus and primary rewards from trading fees and Curve DAO tokens. Curve’s stablecoin specific designed algorithm is a more unique advantage.

It minimizes impermanent loss, optimizing returns. Curve also offers advanced earning opportunities for users who lock CRV tokens and provides complete decentralized control over the users’ funds. Transparency, strong DeFi innovations, and highly optimized yield mechanics showcase Curve Finance’s DeFi rewards for stablecoin earners.

Curve Finance – Features

- Stablecoin optimized liquidity pools. Low-slippage.

- Earn from trading fees received and CRV incentives accrue for value.

- Users always control their funds. Full DeFi transparency.

9. Aave

Aave is considered one of the best platforms for crypto staking for stablecoins in crypto lending markets. Users can earn interest from the borrowers on the networks after supplying stablecoins like USDT, USDC, and DAI in Aave liquidity pools.

Aave’s risk management system, consisting of over-collateralized loans, real-time monitoring, and automated liquidations is crucial to protect lenders. Besides, Aave is the only platform in the market to offer flexible withdrawals, governance opportunities through the AAVE token, and multi-chain support across major blockchains.

Aave has stablecoin passive income lending positions on the platform, offering full transparency, non-custodial control, and flexible while conserving all of the principles of DeFi.

Aave – Features

- Decentralized lending markets with steady income on your crypto.

- Risk is protected when borrowing is over-collateralized.

- Instant liquidity and works on multiple blockchains.

Pros & Cons Crypto Staking Platforms for Stablecoins

Pros of Stablecoin Staking Platforms

- Limited Volatility – Stablecoins do not fluctuate in price, which makes predicting earnings easier.

- Earning Rewards with Simple Tasks – Rewards are earned simply by holding coins instead of leaving them idle.

- User-Friendly – Many centralized platforms perform the complex tasks for the customers.

- Better Rewards Compared to Banks – Staking stablecoins offers higher returns than the interest on savings accounts.

- Flexible Liquidity Options – Process of stablecoin staking offers users the option of flexible or locked staking.

- Variety of Platforms and Coins – There is the option to diversify stablecoins and staking services.

- Helpful to the Blockchain Ecosystem – Better the efficiency and growth of liquidity of the network.

Cons of Stablecoin Staking Platforms

- Security Risks of Centralized Exchanges – There is a risk of losing trust in exchanges to secure on your funds.

- Restrictions on Withdrawals – Some staking periods may delay your access to funds for a duration.

- Unpredictable Returns on Staking – Returns may drastically fall, in some cases to zero, as a result of a self-defined or external market circumstance.

- Risk of Losing Crypto – There is a risk of losing funds due to technical glitches, hacks or other undocumented activities of smart contracts.

- Unpredictable Future of Legislation – Currently and as of late September, the regulations on stablecoins and consequently on staking will change.

- Withdrawal Fees or Restrictions – Certain platforms impose fees or loyalty tier requirements before you can access the upper tier rates.

Conclusion

Most importantly, when it comes to crypto staking platforms specifically for stablecoins, it deals with determining security, flexibility, and earning potential.

For the more beginner platforms with regulated protections and reward tracking, centralized platforms like Binance Earn, OKX Earn, Nexo, and Coinbase work. DeFi options include Curve Finance and Aave, which provide more control and transparent, decentralized yield generation.

There is a platform for every kind of investor whether it is daily payouts, higher APYs with tier benefits, or sophisticated earning strategies. Stablecoin staking on trustworthy platforms works for anyone attempting to passive income.

FAQ

Popular options include USDT, USDC, DAI, BUSD, and TUSD, across both centralized and decentralized platforms.

Staking stablecoins typically has lower price risk since they are pegged to fiat currency. However, security still depends on the platform’s protection measures, regulatory compliance, and whether the funds are custodial or decentralized.

Stablecoin staking platforms allow users to lock or lend their stablecoins to earn rewards. The platform uses your funds to support liquidity, validate networks, or power lending activities and returns a share of the earnings to you.

Earnings vary by platform and market conditions. Some centralized services offer modest but stable APYs, while certain DeFi options provide higher returns but may involve greater risk.