This article outlines the Best Crypto DeFi Dashboards for Multi-Chain Analytics, which help users monitor their assets, liquidity pools, and yield farming across different chains.

These dashboards consolidate data and provide real-time insights, risk assessments, and an overall DeFi portfolio analysis, allowing for effective and streamlined investment management. Such dashboards are valuable for novices and advanced users alike.

What is Crypto DeFi Dashboards?

Crypto DeFi dashboards serve a particular function by allowing customers a unified perspective of their activities in decentralized finance (DeFi) over various blockchains.

These dashboards combine information from multiple DeFi services, such as lending, borrowing, staking, yield farming, and liquidity provision, allowing customers to visualize their holdings, income, and portfolio analytics in real-time.

Decision-making and the management of digital assets become easier because DeFi dashboards provide in-depth analytics, histories of each transaction made, and risk evaluations, which remove the burden of switching between platforms.

Everyone, regardless of expertise in DeFi, needs these dashboards as they provide the most important feature of being able to manage and control one’s investments.

Why Use Crypto DeFi Dashboards for Multi-Chain Analytics

Unified Portfolio Management.

- Feature: All DeFi assets, staking positions, and liquidity pools are consolidated across different chains.

- Benefit: View your entire portfolio at once, instead of having to use multiple platforms.

Real-Time Data & Updates.

- Feature: Monitors tokens, yields, and protocols activities.

- Benefit: Make strategic decisions and react quickly as the market makes moves.

Risk Assessment & Management

- Feature: Measures exposure to protocols and impermanent loss, as well as possible volatility.

- Benefit: Handles risk more strategically and loss mitigation.

Strategy Optimization.

- Feature: Tracks and assesses return values across chains, protocols and yield farming, opportunity.

- Benefit: Helps you earn more on your investments and strategic decision making.

Enhanced Transparency & Insights.

- Feature: Analyzes on-chain metrics, historic and comprehensive data.

- Benefit: Provides a simplified understanding of market behaviors, protocol yield, and available investment opportunities.

Simplified Tax & Transaction Tracking.

- Feature: Merges activities across blockchains.

- Benefit: Makes auditing and accountability a lot simpler.

Key Point & Best Crypto DeFi Dashboards for Multi-Chain Analytics List

| Platform | Key Points / Features |

|---|---|

| DeFiLlama | Tracks TVL (Total Value Locked) across multiple DeFi protocols; supports multi-chain analytics; free and open-source. |

| Dune Analytics | Customizable dashboards using SQL queries; community-driven data insights; real-time DeFi analytics. |

| Zapper | Aggregates DeFi assets and liabilities; supports yield farming & portfolio tracking; multi-chain integration. |

| Token Terminal | Fundamental analysis of crypto projects; protocol revenue & valuation metrics; useful for investment insights. |

| Coinalyze | Real-time crypto charts and data; derivatives & DeFi tracking; multi-exchange integration. |

| DEXTools | Focused on decentralized exchange analytics; live trading charts; token tracking & alerts. |

| Nansen | On-chain analytics with wallet labeling; tracks smart money and large transactions; DeFi insights. |

| Debank | Portfolio tracking across multiple chains; DeFi protocol explorer; NFT & token analytics. |

| Revert Finance | Tracks impermanent loss & liquidity pool performance; DeFi risk assessment; multi-chain support. |

| GMGN.ai |

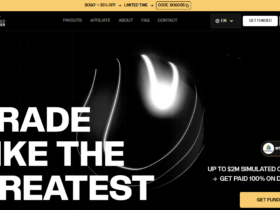

1. DefiLlama

DeFiLlama is recognized as one of the finest crypto DeFi dashboards for multi-chain analytics due to its simplicity, transparency, and broad coverage. Unlike others, it provides a consolidated view on Total Value Locked (TVL) on hundreds of DeFi protocols on several blockchains.

Being open source means accurate, verifiable, and community-driven improvements are possible. Supporting lesser-known chains is an excellent resource for scouting emerging projects.

Not requiring an account, providing real-time alerts, and offering easy-to-use graphs are valuable features for monitoring portfolio performance, tracking the growth of protocols, and analyzing cross-chain trends, which is why serious DeFi investors use it the most.

DeFiLlama Features

- Multi-Chain TVL Tracking: Keeps track of all chains and indexes all of the DeFi protocols within each chain and tracks the Total Value Locked in each protocol.

- Open-Source Transparency: Community-sourced and verifiable information is a hallmark of reliability.

- Simple Interface: With a set of dashboards, top protocols are identified and ranked, ensuring charts are readable.

2. Dune Analytics

Dune Analytics is exceptional among multi-chain analytics DeFi dashboards because of its unique ability to offer fully customizable visualizations of on-chain data.

Its ability to facilitate any users crafting SQL queries on blockchain data to gain insights on transactions, protocols, and even users across multiple chains is unparalleled.

While free aggregated DeFi data and analytics are available, they are usually of poor quality—Dune avoided this problem by combining real analytics with endless community contributions in the form of ready dashboards.

Defi users can fine-tune their trend analytics, money flow analytics, and even protocol performance evaluation. This level of analytics is so far unparalleled in the industry, and the level of transparency explains why Dune Analytics has so many active users.

Dune Analytics Features

- Custom Dashboards: Users may tailor dashboards and analytics to their liking and their needs using SQL queries and performing blockchain analytics.

- Community Library: A large number of dashboards, designed and shared by users, is available.

- Real-Time Analytics: Across multiple chains, protocol analytics, transactions, and users are tracked within set timeframes.

3. Zapper

Zapper offers seamless multi-chain DeFi portfolio management in a unified dashboard, position- and yield-optimizing integrated portfolio view, and consolidated asset overviews including farming strategizing all under one integrated multi-chain DeFi portfolio management suite.

DeFi portfolio management-optimized user control and automated servicing of liquidity pools, token swaps, investments, and position-taking simplify DeFi pool management.

Proactive portfolio management and opportunity-set analytics integrated DeFi yield optimizing tools take portfolio management automating analytics, Zapper’s automated portfolio-optimizing analytic tools make Zapper a leading multi-chain DeFi portfolio suite.

Zapper Features

- Portfolio Aggregation: DeFi asset portfolios are consolidated in a single view, providing a central overview of a user’s assets, liabilities, and liquidity positions.

- DeFi Interaction: The platform directly provides abilities for users to stake, swap, and control their investments.

- Cross-Chain Support: Ethereum, BSC, and Polygon are just a few of the blockchains available for tracking and monitoring.

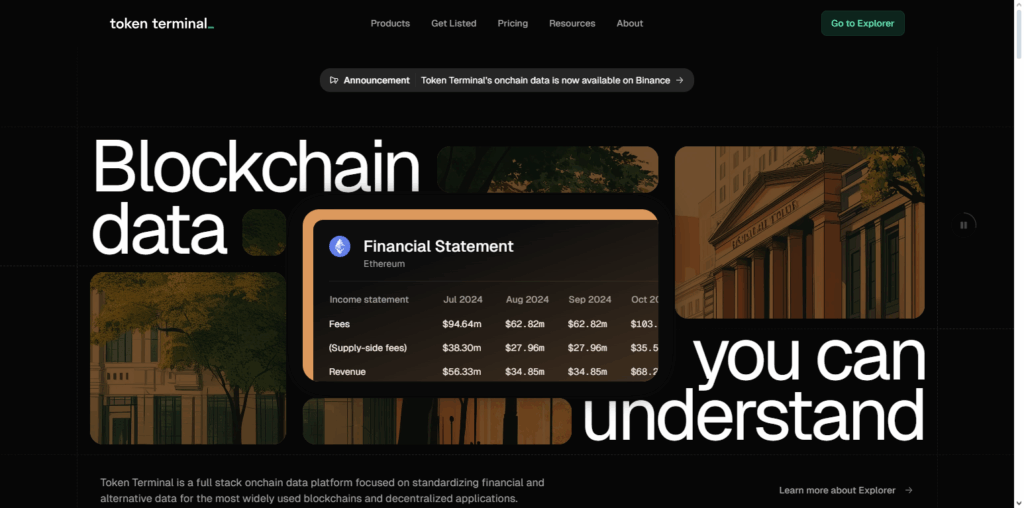

4. Token Terminal

Token Terminal is an exceptional crypto DeFi dashboard for multi-chain analytics since it combines traditional finance indicators and blockchain data, allowing users to see how protocols perform through an investor’s lens.

Most dashboards focus on the crypto DeFi space in which Token Terminal excels on fundamental analysis, describing revenue, earnings, and valuation for DeFi projects spanning multiple chains.

Token Terminal allows users to analyze protocols as if they were traditional companies, assessing metrics on growth, profitability, and sustainability. Token Terminal’s multi-chain analytics capability allows users to investigate emerging opportunities beyond Ethereum.

Token Terminal combines and cross-references disparate data to provide transparent and detailed financial insights, equipping users with the information they need to make strategic, data-driven investment decisions.

Token Terminal Features

- Fundamental Analysis: Revenue streams and quantitative metrics are tracked for multiple chains and DeFi projects, ensuring comprehensive analysis.

- Multi-Chain Coverage: Beyond Ethereum, other chains and projects are analyzed to promote an all-around investment analysis.

- Financial Insights: The traditional metrics of financial analysis and other charts serve to provide a comprehensive analysis of a company.

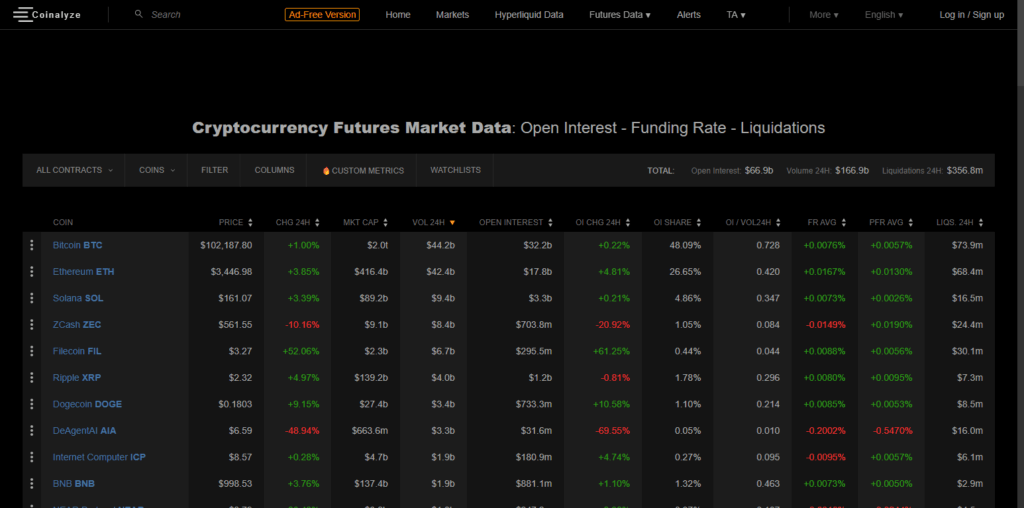

5. Coinalyze

Coinalyze integrates real-time analyses of market data and insights on various trading protocols for both traders and DeFi investors on a user-friendly crypto DeFi dashboard for multi-chain analytics on various use cases and DeFi protocols.

It also enables customers to track liquidity and price movements in real-time DeFi positions with its proprietary derivative track and multi-chain token analytics. It also features advanced alert systems for customer-modifiable chart instruments to optimize on-the-minute strategies.

It integrates multiple chains and ecosystems to ensure no gaps in real-time coverage. For these reasons and the combination of multi-chain systems and analytics depth, Coinalyze remains indispensable for active DeFi dashboard management.

Coinalyze Features

- Access to Live Market Data: Displays current charts for tokens, liquidity pools, and derivatives.

- Analytics for Many Chains: Follows assets and protocols across many blockchains.

- Enhanced Charting Features: Supreme strategy detail with alerts, trend analysis, and accurate data.

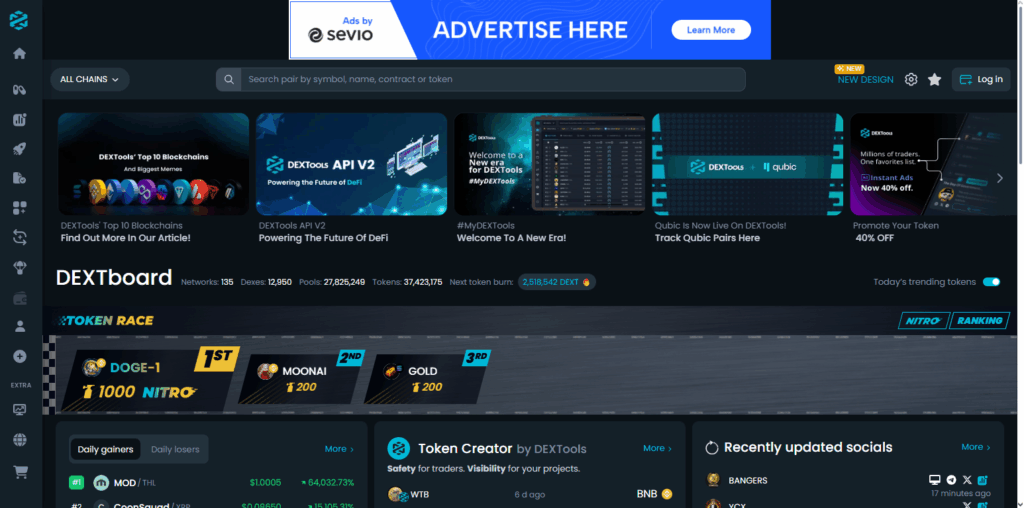

6. DEXTools

DEXTools is arguably one of the best crypto DeFi dashboards due to its focus on multi-chain analytics. Unlike its competitors DEXTools specializes in tracking decentralized exchanges, delivering in-depth performance analytics on tokens and chains.

What really sets DEXTools apart is the ability to gauge real-time trading pairs, monitor liquidity, and oversee pool price movements, which can really inform your trend and opportunity detection. Informed decision-making is aided within DEXTools by token analytics, smart alerts, and social sentiment tracking.

DEXTools stands out with the ability to analyze and manage assets throughout various decentralized networks with their multi-chain capabilities, streamlined dashboards, and comprehensive insights.

DEXTools Features

- DEX Supervision: Supervision of trading pairs, liquidity pools, and shifts in token price.

- Real-Time Token Rate Statistics: Real-time token analytics on performance, volume, and market trend recognition.

- Instant Notifications: Sends alerts for critical market events or drastic price shifts.

7. Nansen

Nansen is among the best crypto DeFi dashboards and analytics tools for multi-chain analytics, as it combines on-chain data and sophisticated wallet classification. What truly differentiates Nansen is the ability to follow the “smart money,” allowing customers to discern investment trends and opportunities as they arise.

Nansen furnishes a complete analysis of a user’s data for token and liquidity movement, as well as for the activity of various protocols.

Nansen has integrated multi-chain facility with user-friendly dashboards and intelligent analytics to streamline the data analysis process of investors, traders, and researchers so they can make well-informed decisions in an unpredictable and rapidly changing DeFi environment.

Nansen Features

- Combining Wallets: Identifies trend analyzation through smart money, and large holders and tackes key wallets.

- Within and Cross-Chain Analytics: Analyzes token flow, liquidity, and protocol engagement.

- Cross-Chain Analytics: Ethereum coverage along with other chains to help identify opportunities before others.

8. Debank

Debank ranks highly among crypto DeFi dashboards used for multi-chain analytics because it details clients’ assets and liabilities and encloses activities for varied DeFi protocols and multiple blockchains.

It excels in portfolio consolidation since investors can follow their tokens, NFTs, and various liquidity positions under one interface. It also helps clients in project discovery and risk management by offering exhaustive insights into various protocols, yield farming, and overall DeFi leading metrics.

With multi-chain integrations, real-time synchronization of data, and system-embedded analytics for easy interpretation, Debank lets users evaluate, adjust, and resolve their performances in active DeFi participation, thereby optimizing strategy.

Debank Features

- Portfolio Tracking Displays DeFi assets, liabilities, and NFTs across chains, constructs portfolios, and offers patch DeFi.

- Yield Tracking Consistently checks for rewards and opportunities to improve returns.

- DeFi Stats and Explorer Transparency: Check details and rankings for DeFi projects.

9. Revert Finance

Revert Finance is a multi-chain DeFi dashboard pioneer in the field of tracking impermanent loss and liquidity pool analytics.

This is a feature most dashboards overlook. Its refinements of the intricacies of the decentralized protocols and the various blockchains liquidity provisioning makes it a unique platform.

Analyzing the composition of the pool and the potential loss historical performance, Revert Finance helps in fine-tuning user DeFi strategies.

Real-time analytics, multi-chain support, and user-friendly visualizations aid in risk management and return optimization, qualifying it as an indispensable tool for liquidity providers and enthusiasts within the DeFi space.

Revert Finance Features

- Multichain LP Position Management: cross-tokens blockchains fluidly tracks liquidity.

- Liquidity Pool Assessment: Examine liquidity pools for risk within and across chain, evaluating potential return, and measuring

- Assessing Impermanent Loss: Analyzes potential losses over time and tracks healing liquidity pools.

10. GMGN.ai

GMGN.ai is an ‘all in one’ dashboards for traders and investors in DeFi and is customized for multi-chain investors. GMGN.ai is focused in Solana and Ethereum but also extends its analytics and trading capabilities to BNB Chain, Base and others blockchains. GMGN.ai combines enhanced real-time support, smart money tracking, and safety and analysis tools.

GMGN.ai provides real-time analytics for investors in new tokens, provides smart wallet tracking, and token metric analysis, and all in one platform. GMGN is an excellent solution for DeFi investors that need to have decentralized ecosystems to trade and invest in.

Pros & Cons Crypto DeFi Dashboards for Multi-Chain Analytics

Pros

- Unified Portfolio Tracking – View all your assets, liquidity pools, and staking positions on different chains within a single screen.

- Realtimeness & Analytics – Get instant data on token prices, yield farm, and the performance of various protocols.

- Risk Management – Assess and locate impermanent losses, protocol exposures, and overall portfolio risk on cross chains.

- Stratefy Optimization – You can analyze and select the most profitable chains and protocols,strategies to optimize yield and efficiency.

- Transparency & Insights – Offers on-chain metrics, and wallet tracking, and captures performance metrics over various timeframes.

Cons

- Beginners Complexity – The sophisticated measurements, and data across different chains could be tricky for novice users.

- Draw data accuracy constraints – Some dashboards for smaller protocols or newer chains can be slow in providing real-time data.

- Staying Platform Dependent – Solely depending on the dashboards may lead to bypassing off-chain activities or potential external risks.

- Subscription Cost – Some advanced analytics tools are available only with a paid subscription.

- Security Risks – Wallets or accounts linked to dashboards could expose the user to privacy threats or phishing patterns.

Conclusion

To sum up, users of crypto DeFi dashboards for multi-chain analytics have gained critical instruments for managing their assets. Tools have become essential for investors, traders, and DeFi users who demand insight and mastery over their assets.

DeFiLlama, Dune Analytics, Zapper, Token Terminal, Coinalyze, DEXTools, Nansen, Debank, and Revert Finance have varying characteristics—in some cases offering real-time portfolio monitoring and cross-chain portfolio analytics, other offering deep analytics with risk grading.

These dashboards unite the disparate data of various protocols and chains, easing the decision-making process and improving intervention clarity. These instruments empower users to traverse the complicated terrain of DeFi with precision, making strategic investments based on solid evidence.

FAQ

Crypto DeFi dashboards are platforms that aggregate and visualize data from multiple blockchain networks. They allow users to track assets, staking, liquidity pools, yield farming, and protocol activity in one place, providing insights into portfolio performance and DeFi trends.

A multi-chain dashboard enables users to monitor investments across different blockchains like Ethereum, Binance Smart Chain, and Solana without switching platforms. This provides a unified view, real-time updates, and better risk management for diverse portfolios.

Most dashboards are safe for tracking and analytics, as they do not require storing funds. However, users should be cautious when connecting wallets or signing transactions, ensuring the platform is legitimate to avoid phishing risks.

Some dashboards like DeFiLlama are fully open and do not require an account, while others like Zapper or Nansen may require wallet connections or sign-ups for full functionality.