This article focuses on some of the Best Crypto Tools for Cross-Platform Trading Automation. When users have multiple exchanges to manage, automation is critical. Automation dramatically decreases the amount of time needed to execute complex trading strategies because the automation tools take care of trading the strategies in the background.

While some tools are designed to help beginners, more advanced automation tools are serious cross-platform tools in that they offer portfolio synchronization, analytics, and risk management. Cross-platform tools are critical tools for automation in the everchanging, busy world of cryptocurrency.

Why Use Crypto Tools for Cross-Platform Trading Automation

Multitasking Made EasyWith crypto automation tools, you don’t have to log in to each exchange to execute a trade, making the process seamless. This time-saving feature ensures you always capture available trades.

Always-On TradingTools automate the process, allowing trades to be executed without your oversight.

Strategic TradingTools automate the complex strategies in crypto trading, such as arbitrage, grid, and algorithmic trading, making them much easier to execute as compared to doing it manually.

Psychological Barriers: Automation helps to remove emotions from the trading process. This leads to the prevention of impulsive and emotionally driven actions that result in losses.

Unified Position Management: Cross-platform tool automation helps to ensure position in trades, strategies, and trading actions are uniform across all tools. This simplifies trade adjustments for better control.

Actionable Insights: Tools automate the collection of data from exchanges and the performance of portfolios, alerting the user of actions that need to be taken.

Increased Work Output: During automation processes, the workload does not increase as you scale in trading larger volumes or multiple crypto assets.

Key Point & Best Crypto Tools for Cross-Platform Trading Automation List

| Tool | Key Points / Features |

|---|---|

| WunderTrading | Supports multiple exchanges, smart trading bots, copy trading, easy interface. |

| 3Commas | Automated bots, portfolio management, DCA & grid bots, cross-platform support. |

| TradeSanta | Cloud-based bots, beginner-friendly, grid & DCA strategies, Telegram notifications. |

| CryptoHopper | Advanced algorithmic bots, backtesting, marketplace for signals, cross-exchange. |

| Coinrule | No-code trading strategies, preset templates, risk management tools. |

| Bitsgap | Arbitrage, demo trading, portfolio tracking, multiple exchange integration. |

| Altrady | Multi-exchange trading terminal, alerts, trading analytics, real-time monitoring. |

| Zignaly | Copy trading, profit-sharing signals, cloud-based bots, minimal setup required. |

| Shrimpy | Portfolio rebalancing, social trading, API integration, multi-exchange support. |

| Autoview | Browser-based automation, trading scripts, integrates with TradingView alerts. |

1. WunderTrading

WunderTrading is a flexible tool for traders interested in Crypto Tools for Cross-Platform Trading Automation. It accommodates several exchanges, builds advanced trading bots, and has copy trading.

Its user-friendly platform facilitates the automation of sophisticated strategies, even for novices. While automated trades are running, users can mirror expert trader portfolios and monitor their account performance in real time, including profit and loss.

The synchronization of strategies across different exchanges permits the consistent execution of trades and risk control while managing execution of trades and eliminating the need for constant supervision of a platform.

WunderTrading Features

- Smart Trading Bots – Implements trading strategies across various exchanges through automated trading using custom or pre-built bots.

- Copy Trading – Users have the ability to replicate the trades of seasoned traders instantly.

- Multi-Exchange Support – Works with seamless integration to Binance, Bybit, FTX, and several other major exchanges.

2. 3Commas

3Commas is an advanced trading automation solution with Crypto Tools for Cross-Platform Trading Automation.

While users manage their trades and portfolios across several exchanges, the platform provides automated trading tools, including grid bots, DCA bots, and several short and long strategies. Its risk management tools like stop loss and take profit automations enable users to control risk in their trading.

The smart trading terminal allows users to execute several moves simultaneously across different exchanges. The platform has copy trading features where users can automate their trades to mirror other traders’s strategies.

3Commas Features

- Portfolio Management – Consolidates and monitors all your crypto assets from various exchanges.

- Advanced Trading Bots – In addition to grid and DCA bots, options bots are available for further trade automation.

- Smart Trade Terminal – Allows you to trade with stop-loss, take-profit, and trailing features across multiple exchanges.

3. TradeSanta

TradeSanta provides users with cloud-based Crypto Tools for Cross-Platform Trading Automation activities for various exchanges and supports grid and DCA bots, customizable signals, and Telegram notifications.

Its ease of use attracts beginners, but advanced automation is also attainable. TradeSanta allows users to run several bots simultaneously, manage multiple portfolio automation, and automated trading for any configured portfolio 24/7.

The minimal interface, especially with most activities performed using prebuilt customizable templates, enables users quick-set configurations for trading automation, and is recommended for users with configured automation for different exchanges and a need for quick, hands-free routed execution.

TradeSanta Features

- Automated Bots – Cloud-based bots operate continuously and can be configured for long, short, or custom strategies.

- Strategy Templates – Provides easily customizable templates to help beginners quickly activate their trading.

- Exchange Integration – Allows cross-platform trading with Binance, Huobi, OKX, and several others.

4. CryptoHopper

CryptoHopper is a professional-grade Crypto Tools for Cross-Platform Trading Automation that combines algorithmic bots, backtesting, and marketplace signals.

When automation of trade across multiple exchanges is needed with specified non-emotional trading techniques, the tool eliminates manual intervention.

Its advanced analytics and strategy designer allows tailoring to individual trading styles, while copy-trading and signal integration expand earning potential.

By centralizing multi-exchange management and offering detailed performance tracking, CryptoHopper ensures efficiency and scalability, making it a top choice for serious traders seeking automation across various platforms.

CryptoHopper Features

- Cloud-Based Automation – Automation of trading processes is conducted exclusively in the cloud, no need for your computer to be switched on.

- Marketplace for Signals – Trade signals, both paid and free, can be obtained from professional traders to direct your trading strategies.

- Backtesting – Evaluate strategies on past data prior to going live.

5. Coinrule

Coinrule is an ideal no-code solution for Crypto Tools for Cross-Platform Trading Automation. Creating grid, DCA, and custom rules is simple using the templates and custom strategy builders.

Connecting different exchanges allows trades to be executed automatically and simultaneously without any manual intervention. Coinrule constructs and enforces risk adherence through stop-loss and take profit orders.

This platform’s ease of use, real-time strategy execution, and monitoring empowers traders to automate complex logic. Providing ease of operation across exchanges, Coinrule is sensitive to the diverse needs of traders and assists those wishing to automate repetitive, time-consuming tasks.

Coinrule Features

- Rule-Based Automation – Use basic automation strategies for trading like “If-This-Then-That” statements.

- Pre-Built Templates – Hundreds of templates available for novice and advanced users.

- Multi-Exchange Connectivity – Automation for entire portfolio on Binance, Kraken, Bitfinex, and more.

6. Bitsgap

Bitsgap consolidates arbitrage, demo trading, and portfolio management into one Crypto Tools for Cross-Platform Trading Automation. Its trading and arbitrage bots allow users to profit from price discrepancies and trade simultaneously across various exchanges.

Users can manage their portfolio, automate strategy execution, and simulate their trades using demo accounts. Bitsgap has an intuitive interface, which lets traders monitor multiple assets and markets simultaneously.

With the level of automation, risk management, and analytics integrated, Bitsgap uniquely empowers users focusing on profit maximization and manual work reduction, offering enhanced control, ease, and functional streamlining.

Bitsgap Features

- Arbitrage Opportunities – Price disparity detection for profit across exchanges.

- Trading Bots – Uses grid and DCA strategies to automate your trades.

- Portfolio Analytics – Analyze and manage multiple exchange accounts from a single dashboard.

7. Altrady

Altrady has a multi-exchange terminal which features real-time alerts, Crypto Tools for Cross-Platform Trading Automation, and analytics. It allows for simultaneous monitoring and execution multi-exchange of trading operations.

Automated strategies, rapid order execution, and customizable dashboards for automated portfolio management are a few other major features.

Altrady’s alert systems and integrated analytics help in error reduction, accelerated error correction, and analytics driven error reduction. Altrady simplifies trading, identifies trading insights, focuses automation where it is manageable, and cross platform trading where it is controllable.

Altrady Features

- All-in-One Terminal – Unified interface for trading on several exchanges.

- Smart Trading & Automation – Trade using advanced order types with automated alerts.

- Market Scanner – Scans for trading signals, price changes, and arbitrage opportunities.

8. Zignaly

Zignaly is a cloud based Crypto Tools for Cross-Platform Trading Automation which principally focuses on copy trading and signal integration.

Automated trading across several exchanges in automation is available where users can follow seasoned traders. It remains flexible enough for advanced strategies and trading thus there are low initial setup requirements.

Zignaly enhances trading efficiency with automated signal execution coupled with a profit-sharing arrangement. The capacity to consolidate several exchange accounts and automate intricate trades places Zignaly as a practical tool for traders in need of fast, cross-platform automation.

Zignaly Features

- Profit-Sharing Copy Trading – Trade profitably using strategies of professional traders.

- Trading Bots – Automate trading by connecting to multiple exchanges.

- Signal Integration – Automate trades using third-party signals.

9. Shrimpy

Shrimpy is an Crypto Tools for Cross-Platform Trading Automation that provides users with powerful features for social trading and portfolio rebalancing. Users can automate strategic rebalancing, copy top traders, and keep an eye on several exchange accounts.

With Shrimpy’s API connectors, users can trade without any manual engagement, and they can also analyze their trading patterns. Unlike many competitors, Shrimpy takes a long-term perspective on portfolio management which makes sense for users who want calmer and continuous growth as opposed to hyperactive speculation.

Shrimpy combines social trading and automation with the management of multiple exchanges, and hands down, it makes the best solution for streamlining and minimizing the manual work involved trading.

Shrimpy Features

- Portfolio Rebalancing – Adjust your portfolio for the long term and automate the shifts as needed.

- Social Trading – Follow and copy strategies from other successful crypto investors.

- Integration of API Exchange – Compatible with exchanges like Binance, Kraken, and Coinbase.

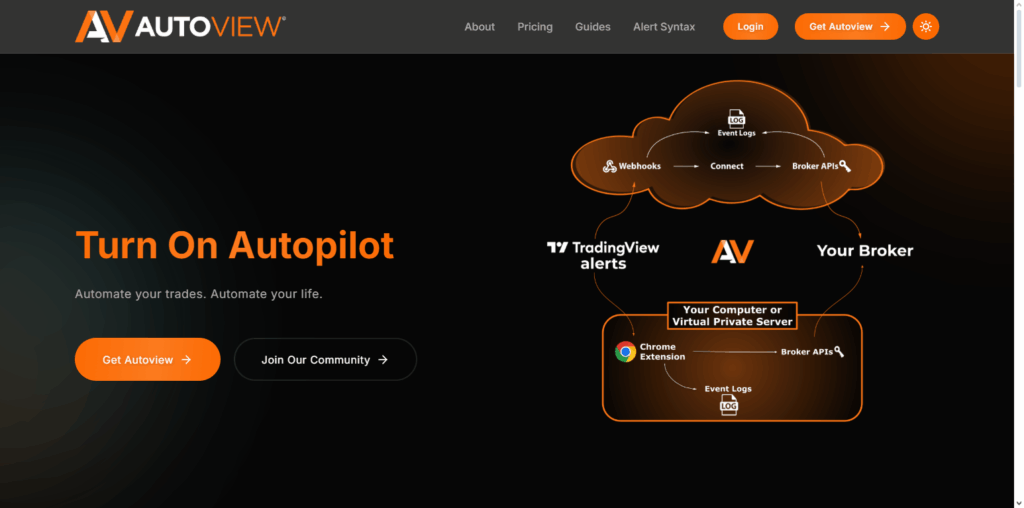

10. Autoview

Autoview provides an automation feature for Crypto Tools for Cross-Platform Trading Automation for alerts on TradingView and multiple exchanges. It provides a seamless bridge between trade analysis and execution by script automation of trade execution.

With Autoview, traders can implement advanced and highly flexible Autoview scripts to trading strategies. Autoview also supports consolidated trading on multiple exchanges. Autoview’s functionality is designed to eliminate the need to supervise trade execution, facilitating round-the-clock trading without manual supervision.

With Autoview, traders can implement real-time, automated trading strategies, based on live TradingView indicators and signals. The combination of these features and the cross-platform functionality makes Autoview one of the best automated trading solutions in the market.

Autoview Features

- Tool for Browser Automation – Directly trades through browser-based script automation.

- Automation of Custom Strategies – Advanced strategies using TradingView alerts are permitted.

- Execution Across Multiple Platforms – Trading through API connections is facilitated on several exchanges.

Conclusion

Automation through crypto tools allows traders to seamlessly handle numerous exchanges, implement strategies continuously, and minimize emotional trading.

Services such as WunderTrading, 3Commas, CryptoHopper, and Autoview have designed their systems to fit well with any user’s needs, whether novice or advanced, through features like automated trading bots, portfolio synchronization, copy trading, and sophisticated trading tools.

We are able to optimize and enlarge our operations with the advanced tools available and at the same time, have our risks contained. With the dynamic nature of the crypto trading, automation of trading processes across various platforms is more of a necessity in order to gain optimal trading benefits from multiple exchanges.

FAQ

Yes. Most tools, including WunderTrading, CryptoHopper, and Autoview, run cloud-based bots that trade continuously without needing your manual oversight.

Reputable tools use API keys to connect with exchanges without storing your funds. Always use secure, trusted platforms, enable two-factor authentication (2FA), and avoid sharing private keys.

Yes. Many platforms, such as WunderTrading, 3Commas, Zignaly, and Shrimpy, offer copy-trading features that let you mirror experienced traders’ strategies across multiple exchanges.