This article focuses on the Best Crypto Exchanges with Auto-Liquidity Features. These exchanges facilitate trading by automatically supplying liquidity which guarantees seamless transactions and reduces the likelihood of slippage.

Irrespective of whether you are a novice or a fully-fledged trader, auto-liquidity platforms such as PancakeSwap, Curve Finance, and Camelot DEX work to make reward earning and token trading activities seamless, quicker, and more productive.

What is Crypto Exchanges?

A crypto exchange is an online venue where individuals can purchase, exchange, and trade digital currencies like Bitcoin and Ethereum, along with other cryptocurrencies. These platforms serve as middlemen between purchasers and sellers, offering analytics and multiple options for trading, including wallets, order types, and real-time trading value graphs.

Centralized exchanges (CEXs) take control of customers’ money and implement KYC authentication for account creation, in contrast to decentralized exchanges (DEXs) which let users transact directly on the blockchain in peer-to-peer relationships without middlemen.

Without exchanges, the ecosystem for digital currencies would not be able to implement liquidity, present a range of values for customers, or provide access to the worldwide marketplace.

Why Use Crypto Exchanges with Auto-Liquidity Features

Instant Trade Execution – Cleared auto-liquidity provides instant execution of buy/sell orders without any lag, even for larger amounts. This minimizes the chances of order/book price distortion.

Stable Prices – Automatic liquidity pools stabilize extreme price fluctuations as the system instantly adjusts the supply/demand of tokens.

24/7 Trading Access – Auto-liquidity systems ensure constant liquidity, which means trading can happen anytime whether there is active market participation or not.

Lower Transaction Costs – Crossed liquidity pools provide a cost saving opportunity to exchanges and users when compared to order book systems.

Improved Market Efficiency – Auto-liquidity and the stable price system create ease of trading which helps both retail and institutional participants with risk/price discovery.

Key Point & Best Crypto Exchanges with Auto-Liquidity Features List

| DEX/Platform | Key Features |

|---|---|

| PancakeSwap | Fast and low-cost transactions, yield farming, NFT marketplace |

| Curve Finance | Optimized for stablecoin swaps, low slippage, high liquidity pools |

| SushiSwap | Multi-chain support, yield farming, staking, community governance |

| Balancer | Customizable liquidity pools, automated portfolio management, low fees |

| Trader Joe | Avalanche-based DEX, farming & staking, lending/borrowing features |

| Quickswap | Polygon network DEX, low fees, fast swaps, liquidity mining |

| Raydium | Solana-based, AMM with order book integration, yield farming |

| THORSwap | Cross-chain swaps, liquidity aggregation, decentralized routing |

| Maverick Protocol | Low slippage trades, concentrated liquidity, advanced AMM design |

| Camelot DEX | Ethereum/Arbitrum based, fast swaps, liquidity incentives |

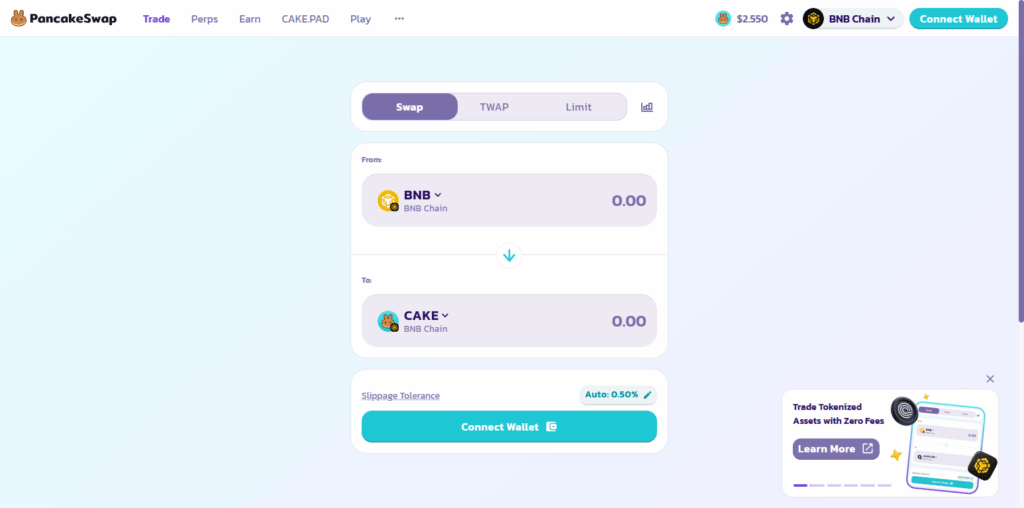

1. PancakeSwap

One of the most automated market-making (AMM) technology exchanges having a seamless integration of automated order book exchange liquidity features. It does not require a counter party with its liquidity pools, allowing users to transact token instantaneously.

It’s auto liquidity feature systems balances of the exchange tokens pools to reduce price slippage, even in high volume, fast executing and efficiently in poorly trading unstable environments. It’s fast trading sneakers provides a reliable and lucrative trading experience. Also, having a stake on the Binance Smart Chain provides.

Ultra cheap and fast confirming transaction speeds. Small and large traders appreciate and seek the fast and cheap transaction speeds. Having a innovative exchange perimeter in today’s DeFi ecosystem greatly enhances the liquidity and community participation systems of yield farming, staking, and lottery incentives.

Pros & Cons PancakeSwap

Pros:

- Auto-Liquidity: No manual intervention is required for continuous trading, as PancakeSwap automatically adds liquidity to trading pools.

- Low Fees: The platform is cost-efficient as transaction fees are usually lower than those charged by Ethereum-based DEXs.

- User-Friendly Interface: Features for swapping, staking, and farming are simple, making the platform easy for beginners.

Cons:

- BSC Dependence: It runs on binance smart chain which is less decentralized than Ethereum.

- Impermanent Loss Risk: LPs are exposed to potential losses if the price of the tokens in the pair move unclearly.

- Limited High-Value Assets: Some major tokens are not available for liquidity and trading.

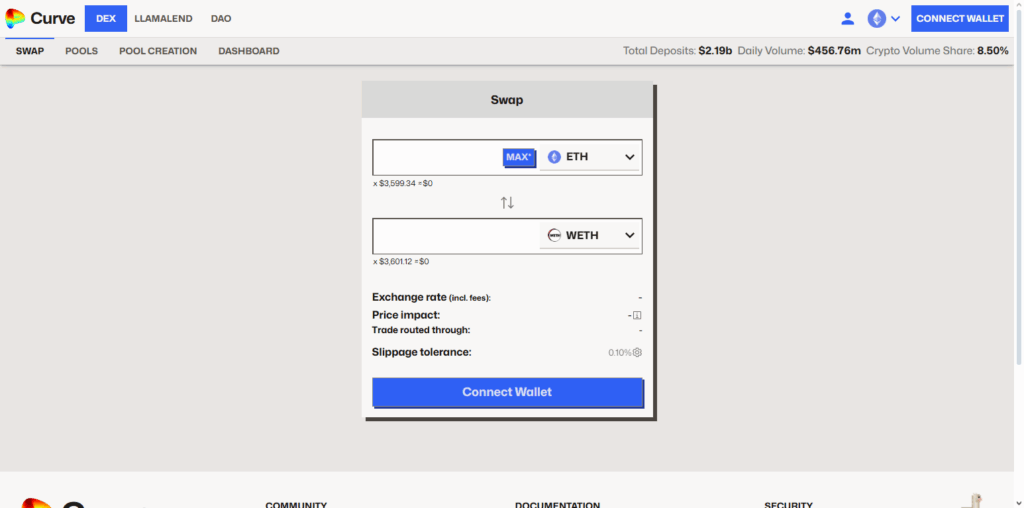

2. Curve Finance

Curve Finance is one of the best crypto exchanges with auto-liquidity features as it is tailored for stablecoin and pegged-asset trading, where the importance of slippage is critical.

Its automated market maker (AMM) protocol actively striking a balance of token pools to ensure liquidity for large and small trades with no significant price alterations. Unlike generic DEXs, Curve’s algorithm is tailored for high capital efficiency, where users can swap assets with virtually zero slippage and accrue provider liquidity fees.

Its auto-liquidity mechanism adapts to changes in demand, flexibly and predictably, to promote safe trading. Furthermore, Curve’s partnerships in DeFi yield farming along with liquidity incentives draw immense liquidity, furthering their reputation as a trusted and low-risk environment for liquidity providers.

Pros & Cons Curve Finance

Pros:

- Stablecoin Optimization: This is true for stablecoin swaps with low slippage during the swapping.

- Auto-Liquidity Pools: LPs are rewarded for their liquidity and curve finance maintains the pools automatically.

- Low Slippage: Suitable for large volume transactions as Curve allows you to move a lot of value without shifting the price.

Cons:

- Complex UI: For those ignorant of DeFi, the UI may prove intimidating.

- Limited Asset Variety: The range of assets in the platform is mainly stablecoins and wrapped assets.

- Governance Token Volatility: The CRV token price changes frequently and may alter available yield thereby adding risk in governance.

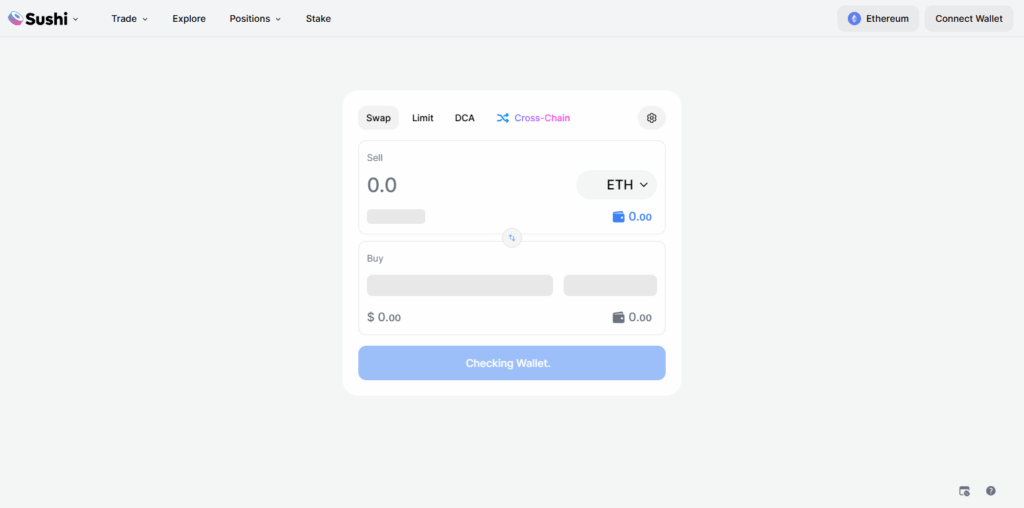

3. SushiSwap

SushiSwap is touted among the best crypto exchange options thanks to auto-liquidity functionality. Sitting on a multi-chain, self-governing suite of services, SushiSwap has a self-configuring AMM system, is able to maintain the execution of a token swap, and minimize slippage even with auto-liquidity pools.

SushiSwap is community-governed, community-driven, and community-minded and has self-governing sets of AMM functionalities as auto-liquidity pools. The innovative incentivization systems built around SushiSwap include yield farming, staking, and liquidity mining.

These constant innovations drive liquidity in the system. The self-governing SushiSwap systems operate on cross-chain supported services, affording the use of and exchange different currencies on a wide variety of chains. SushiSwap is a reliable exchange in the DeFi space. This is a consequence of auto-liquidity as well as the community, for either casual or elevated streamlined trade.

Pros & Cons SushiSwap

Pros:

- Cross-Chain Availability: This expands trading opportunities to a greater number of users.

- Auto-Liquidity Rewards: There is automatic distribution of fees and rewards to LPs.

- Community Governance: The governance participation is made possible from SUSHI tokens.

Cons:

- Smart Contract Risk: The exploits and bugs that other DeFi platforms have also apply to them.

- Moderate Fees: The fees on some of the networks are a little higher than PancakeSwap.

- Impermanent Loss: LPs still have the risk of price volatility within the range.

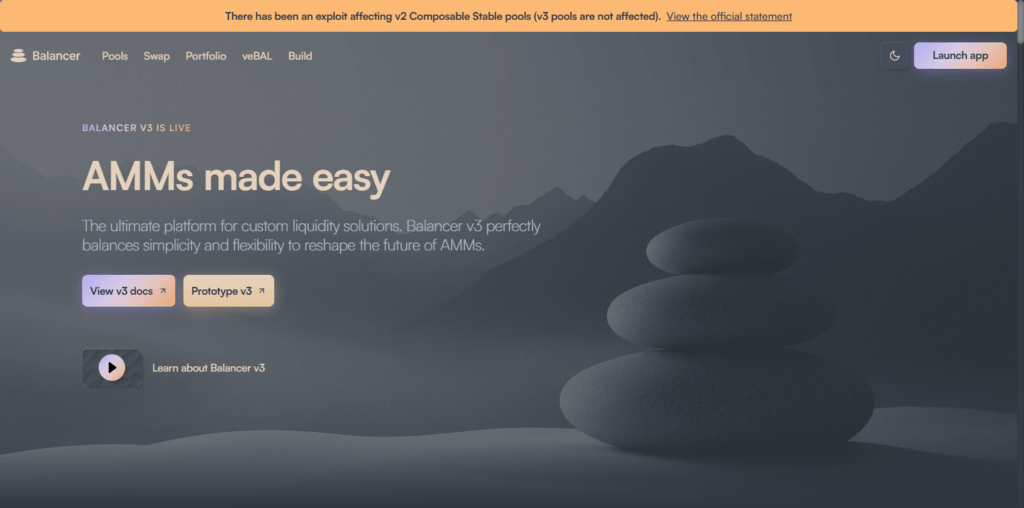

4. Balancer

The wide variety of options offered by Balancer makes it one of the best Crypto exchanges with auto-liquidity functionality. Balancer steps beyond typical liquidity pools by providing customizable automated market-making (AMM) systems.

Balancer’s auto-liquidity system rebalances pools due to market changes, minimizing the adverse effects of liquidity consumption and providing stable pricing to the user. Balancer stimulates the participation of liquidity providers by offering rewards and fee-sharing through the system of liquidity participation.

Balancer’s responsive capital system, coupled with the distinct auto-liquidity management and customizable pools system, allows Balancer to fill the need with traders and DeFi users optimal situations which include flexibility, stability, and constant availability of liquidity.

Pros & Cons Balancer

Pros:

- Customizable Pools: Multiple token pools and custom weighting is allowed.

- Auto-Liquidity Provision: Pools have token ratios that are automatically balanced.

- Yield Farming: LPs can earn rewards and gain exposure to a range of different assets.

Cons:

- High Complexity: The system’s many advanced features could confuse people new to the system.

- Gas Fees: The cost of performing transactions at the gas stations can become expensive.

- Lower Volume: Less popular pairs can… are subject to the low liquidity.

5. Trader Joe

As one of the best crypto exchanges with auto-liquidity features, Trader Joe combines the fast, Avalanche-based decentralized exchange with an efficient automated market-making system. Its auto-liquidity pools allow seamless token swaps with minimal slippage during even the most extreme high-volume trading.

Trader Joe’s comprehensive and self-sufficient DeFi ecosystem, which comprises staking, yield farming, lending, and borrowing, was unprecedented at the time and has ensured the platform attracts plentiful liquidity and active participation.

The Avalanche network’s integration with the platform has ensured near real-time and cost-effective trading due to ultra-low transaction fees and rapid transaction confirmations. Thanks to innovative liquidity mining, active community governance, and multifunctional DeFi components,

Trader Joe’s liquidity providers, and traders operate in one of the most reliable and high-performance environments and gain access to sought-after DeFi stability, along with plentiful growth opportunities.

Pros & Cons Trader Joe

Pros:

- Avalanche Integration: The speed of transactions is great and fees are low on the Avalanche network.

- Auto-Liquidity Pools: There is automatic provision of liquidity for traded tokens.

- Staking Rewards: There are rewards for staking and holding JOE tokens.

Cons:

- Network Specific: It is only offered on the Avalanche network which is a limitation for multi-chain users.

- Less Mature: It has a smaller user community than PancakeSwap or SushiSwap.

- Impermanent Loss: There is exposure to volatility in the price of the tokens.

6. Quickswap

Quickswap is amongst the most efficient and cost effective crypto exchanges with self-liquidity since it is on the Polygon network, which provides very quick and low cost transactions and is supported with sophisticated automated market-making (AMM) systems.

Its self-liquidity feature provides traders with the ability to swap tokens on the quick and unbalanced, to an extent, on the over-volatile exchange with assurance and reliability. Quickswap’s position is unique since it focuses on Polygon’s Layer 2 Scalability which is incredibly lower when compared to Ethereum based DEX’s.

Quickswap is also able to keep efficient automated market-making (AMM) systems for the DEX by incentivizing liquidity with yield farming which provides DEX users the ability to stake their tokens. Quickswap is an ideal DEX for all users because of its self-liquidity systems and Polygon based low transaction liquidity capabilities.

Pros & Cons QuickSwap

Pros:

- Polygon Network: Low fees, fast transaction speeds.

- Auto-Liquidity Feature: No need for manual rewards.

- AMM Efficiency: Best for small transactions with little slippage.

Cons:

- Polygon Dependence: Cannot be used on all major chains.

- Limited Token Variety: Not as many tokens as Ethereum based DEXs.

- Less Governance Influence: Limited community participation.

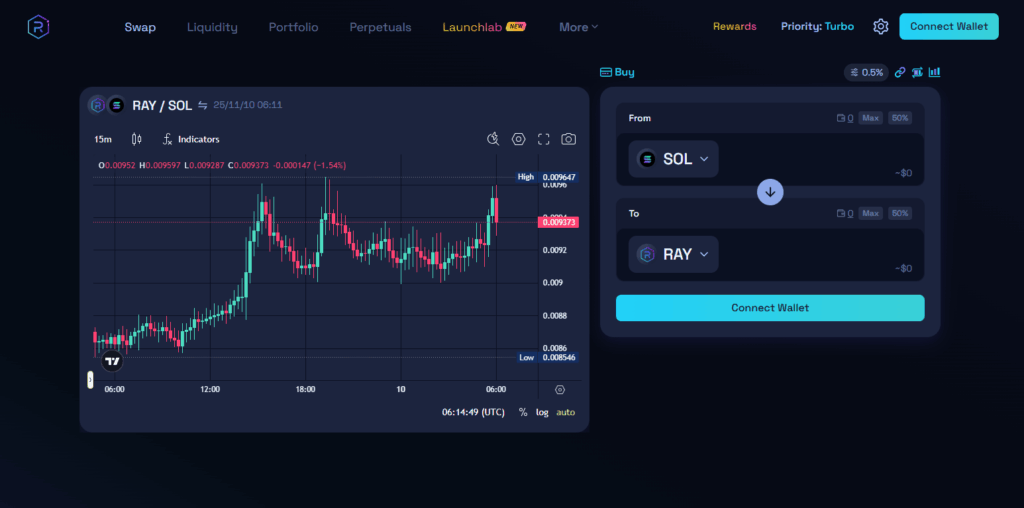

7. Raydium

Raydium has one of the best crypto exchanges because it operates on the Solana blockchain. Users benefit from the advantages of the Solana blockchain because it has fast transactions and low fees. It has one of the best automated market makers (AMM) systems on the market.

During times of high volatility, trades are executed with low slippage, and auto-liquidity available ensures token swaps are executed instantly. Most other exchanges do not offer simple integrated on-chain order books.

Raydium combines on-chain order book systems with automated market makers systems, which has very positive effects on price accuracy and depth of liquidity.

Also, Raydium has yield farming, liquidity incentives, and staking, which continuously attract capital and liquidity to the system. Due to auto-liquidity management in high trading times, Raydium has developed a hybrid order book-AMM system that gives traders a new, fast, and cost-effective way to trade.

Pros & Cons Raydium

Pros:

- Solana Network: Quick transactions, almost no fees.

- Auto-Liquidity Pools: Pools are automated and incentivized.

- Integrated Order Book: Uses AMM and includes order books for efficiency.

Cons:

- Solana Network Risk: High chance of network downtime.

- Limited Token Selection: Less tokens than Ethereum DEXs.

- High Competition: Other DEXs on Solana.

8. THORSwap

THORSwap is one of the best decentralized crypto exchanges that employs innovative automated liquidity systems. It allows users to exchange their tokens and coins across blockchains without the need for third party intervention.

Its unique automated liquidity systems allow for instantaneous execution of orders with little to no slippage for even cross border asset trades. It is perfect for users that need to access and use multiple chains for decentralized finance.

It is cross integrated with the THORChain protocol which helps in the performing of advanced secure and anonymous exchanges while offering layered liquidity for a vast array of resources.

THORSwap’s automated liquidity systems and advanced cross chain capabilities provide a secured and highly flexible platform for traders in need of efficient decentralized crypto trading. THORSwap is guaranteed to perform advanced cross border trading without issues.

Pros & Cons THORSwap

Pros:

- Cross-Chain Swaps: Quickly performs multi-chain token swaps.

- Auto-Liquidity Management: LP positions are automatically managed.

- Decentralized Governance: RUNE tokens allow votes on platform decisions.

Cons:

- Newer Platform: Less liquidity than other DEXs.

- Complexity: Cross-chain functionality may be challenging.

- Token Availability: Less tokens than PancakeSwap or SushiSwap.

9. Maverick Protocol

Maverick Protocol is among the best crypto exchanges as it has autoliquidity features and an efficient AMM Framework that minimizes slippage and maximizes capital efficiency. Maverick Protocol has an autoliquidity framework that lets liquidity pools flow in and out of scope to market conditions, enabling mop and sops to be executed rapidly, and seamlessly, even under harsh market conditions.

Maverick Protocol is different because of its concentrated liquidity, where capital is maintained and its returns are improved by allowing liquidity members to set their capital in specific price ranges.

Maverick Protocol also economically balances and liquidate liquidity pools and provide rewards to capital/ liquidity, traders, and market systems forming strong liquidities in their economic domain.

This makes Maverick Protocol be a developed and dependable option for liquidity seekers, and expanded capital mop and sop to elimination traders, economic sophisticated and innovations.

Pros & Cons Maverick Protocol

Pros:

- Capital Efficiency: Liquidity Automation Maximizes Returns with Less Tokens.

- Auto-Liquidity Pools: Seamless liquidity provisioning.

- Low Slippage: Optimized trading for both low-volume and high-volume pairs.

Cons:

- Niche Adoption: Compared to the major DEXs, the user base is smaller.

- Documentation: Less information for beginners on protocol mechanics.

- LP’s Impermanent Loss: When prices fluctuate, the loss remains.

10. Camelot DEX

Camelot DEX is regarded as one of the top cryptocurrency exchanges because as the best auto-liquidity responder, it integrates rapid trading on Ethereum and Arbitrum with a sophisticated market-making system that guarantees ongoing liquidity for all token pairings.

Its self-liquefying pools permit users to complete transactions right away with little to no slippage, even when the market is particularly volatile. Camelot is designed for the users, and that is what makes it different.

Also, liquidity providers are motivated by liquidity mining and staked rewards. Because of rapid dealings, dependable auto-liquidity, and powerful participatory motivators, Camelot DEX is one of the few exchanges that offers a tokenized trading environment to users focused on DeFi.

Pros & Cons Camelot DEX

Pros:

- Ethereum Layer 2 (Optimism): Enjoy fast transactions and low fees.

- Auto-Liquidity Features: Automated management of liquidity pools and rewards.

- User-Friendly Interface: Simplicity for both amateurs and seasoned users.

Cons:

- Layer 2 Dependence: Optimism only, main Ethereum chain is unavailable.

- Smaller Community: Trading volume is lower compared to major DEXs.

- Token Selection: Limited cross-chain asset options.

Conclusion

To summarize, the most dependable cryptocurrency exchanges equipped with auto-liquidity functionality guarantee seamless, quick, and trustworthy trading experiences by making certain liquidity is present at all times, minimizing slippage, and accommodating any size trade without issues.

Exemplary platforms — PancakeSwap, Curve Finance, SushiSwap, Balancer, Trader Joe, Quickswap, Raydium, THORSwap, Maverick Protocol, and Camelot DEX — are distinguished by their inventive AMM frameworks and automated liquidity management as well as their supportive community-driven incentives, which encourage the circulation and retention of resources in their liquidity pools.

Each exchange has its advantages, whether they are cross-chain swaps, concentrated liquidity, low fees, or quick execution, satisfying the different market preferences of the traders. Ultimately, the auto-liquidity capability is fundamental for contemporary decentralized exchanges and for expanding the scope of profit-earning opportunities in the DeFi ecosystem.

FAQ

They provide fast trade execution, reduced slippage, stable prices, and 24/7 accessibility. Auto-liquidity ensures that large or small trades can happen efficiently, improving overall trading experience.

Crypto exchanges with auto-liquidity features are decentralized platforms that use automated market-making (AMM) systems to ensure liquidity is always available in trading pools, allowing instant token swaps without waiting for a counterparty.

They provide fast trade execution, reduced slippage, stable prices, and 24/7 accessibility. Auto-liquidity ensures that large or small trades can happen efficiently, improving overall trading experience.