In this article, I will discuss the How to Build Passive Income with DeFi and how one can earn passive income through DeFi.

The world of decentralized finance presents numerous opportunities such as staking, yield farming, and lending which provide consistent returns with ease. This guide aims to assist both novice and veteran crypto enthusiasts in effortlessly earning through DeFi.

What is Passive Income?

Passive income, such as renting properties, receiving dividends, or earning interest, can be classified as earnings with little to no work done after the initial setup. In contrast to active income, which entails consistent work, passive stream earnings work overtime and accrue without supervision.

In Decentralized Finance (DeFi) environments, passive income may also arise from staking, yield farming, or lending of crypto assets. Such methods enable the generation of wealth without the need for continuous intervention.

How to Build Passive Income with DeFi

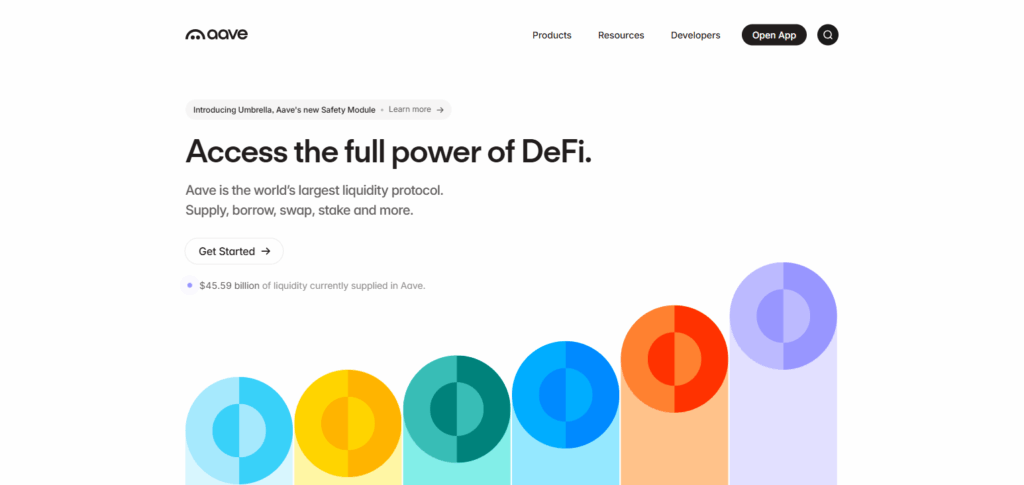

Example: Generate Passive Income by Lending USDC on Aave

Select a Lending Service

- Access Aave, a well-known protocol for decentralized finance lending.

- Link your crypto wallet, like MetaMask

Funding your Aave Account with USDC

- Click Deposit, then choose USDC.

- Approve the transaction in your wallet.

- Your USDC is now contributing to Aave’s lending pool.

Earning Interest

- Interest/loan yields on Aave are paid out based on demand and are generally in the range of 4-8% for USDC.

- The interest adds up automatically, and compounding increases the total earnings over multiple periods.

Magically Returning Cash

- Your principle is USDC, hence, withdraws can be done anytime without worrying about depreciation–the principal stays constant.

- All stablecoins do not depreciate so you can withdraw your capital anytime along with the earned interest.

Monitoring

- With your earnings tracked using DeBank or Zapper, you may also consider diversifying to other platforms offering better yield like Compound or Yearn Finance.

Top DeFi Passive Income Strategies in 2025

Staking

Staking is one of the best strategies of earning passive income in the DeFi space since it entails minimal risk, actively securing a network through locking crypto assets. Staking is especially appealing because of the relative ease of earning rewards; there is no need for complicated trading maneuvers.

With the growing adoption of PoS (Proof of Stake) systems as the industry standard in 2025, more networks will provide greater returns on long-term staking. It combines effortless usability, guaranteed return, and engagement within the ecosystem and thus works well for both novices and experienced investors.

Yield Farming

Yield farming stands out as one of the best passive income techniques in DeFi since users can earn significant returns through providing liquidity. Its distinct feature is the ability to move assets to different pools in order to chase the best possible returns, making it more engaging than simple liquidity providing.

Unlike in staking, transaction fees alongside platform incentives enables dynamic income source. For those aware of risk and timing, it offers unparalleled earning potential by tapping into the ever-changing DeFi landscape.

Risk Management and Security Tips

Use Reputable Platforms: Invest only in DeFi protocols that have a history of properly conducted audits, good reputation, and have a vibrant community.

Diversify Investments: Investing in different platforms or strategies helps reduce exposure to a single point of failure.

Avoid Unknown Tokens: Newly launched or unaudited tokens are not worth the risk and should be avoided.

Be Wary of High APYs: Extremely high returns often come with hidden risks, unsustainable tokenomics, or other dangerous underlying factors.

Use Hardware Wallets: Protect your funds from online hacks by keeping assets in hardware wallets such as Ledgers or Trezors.

Check for Audits: Interacting with unverified smart contracts poses significant risk. Always ensure a qualified firm audits the smart contracts.

Beware of Phishing Scams: Do not approve connection requests from unknown wallets or click on dubious links.

Monitor Activity Regularly: Monitor community alerts, changes to smart contracts, and updates to protocols.

Legal and Regulatory Considerations in 2025

KYC/AML Compliance: All DeFi services are sensitive to identity verification and AML checks, especially hybrid or licensed ones.

Crypto Taxation: Countries regard earnings through staking, yield farming, and lending as taxable; hence accurate reporting is critical.

Regulated DeFi Protocols: The approval or licensing of certain DeFi services by some governments brings additional legal clarity.

Cross-Border Restrictions: Access to some services may be restricted based on the user’s jurisdiction due to regulatory considerations.

Smart Contract Liability: In some jurisdictions, both developers and users face potential liability for losses incurred from smart contracts.

Stablecoin Regulations: More stringent regulations are applied to stablecoins, both algorithmic and fiat-backed, utilized in DeFi activities.

Record-Keeping Requirements: Comprehensive logs of transactions must be maintained for audit and tax reporting by the users.

Privacy vs. Compliance: DeFi applications that prioritize user privacy may be forced to comply with international laws on financial oversight.

Tips to Maximize Passive Income in DeFi

Starting With Stablecoins: Controlled volatility makes stablecoins like USDC and DAI ideal candidates for lending or farming.

Reinvesting Earnings: Earning rewards through DeFi strategies and reinvesting them consistently using compounding strategies.

Using Yield Aggregators: Yield aggregators such as Yearn or Beefy Finance work with your funds and boost your APY by automatic optimization and rebalancing.

Timing the Market: Gain access to high-yield pools and maximize your returns by exiting before tokens are sold at a loss.

Diversifying Strategies: Capture more opportunities by combining staking, lending and yield farming to spread risk.

Keeping an Eye For Governance Updates: Protocol update changes, like the gamified reward system, can affect how much earnings users are getting, so stay updated.

Layer 2 Solutions: Using Arbitrum or Polygon blockchains for DeFi helps reduce gas fees traditionally associated with Ethereum.

Risk Metrics Monitoring: Metrics like TVL (Total Value Locked), APY changes, and protocol audits should be looked after consistently.

Conclusion

Constructing passive income streams with DeFi in 2025 empowers individuals to utilize blockchain technology for wealth accumulation. From staking and yield farming to lending, DeFi supports both novice and seasoned users with flexible income opportunities.

Achieving success, however, requires well-thought-out plans, proper risk oversight, and constant monitoring of platform updates and policy shifts. Carefully managing spending, diversifying efficiently, and employing reliable platforms makes it possible to take full advantage of DeFi to earn stable income with little active effort over time.