In this article, I will discuss the How to Stake with a Pool Aggregator, a more simple and effective way to passively earn income from your cryptocurrency.

Pool aggregators make it easier to combine different staking pools which allows for better reward optimization and lowers the overall risk. This guide is suitable for every level of expertise and outlines the major benefits and steps associated with smart staking.

What is a Pool Aggregator?

A pool aggregator is a service that merges several staking pools into a single interface. It enables users to stake their crypto assets more effectively. Rather than selecting from a list of validators or pools, users can delegate their tokens through the aggregator which aims to distribute them across pools to maximize returns while minimizing risk.

In addition to the main functions, pool aggregators may implement other features like liquidity tokens, auto-compounding rewards, and performance tracking. They make the staking process easier, improving access for novice users while increasing potential profits.

How to Stake with a Pool Aggregator Step-by-Step Process

Example: Staking ETH with Lido (a Pool Aggregator)

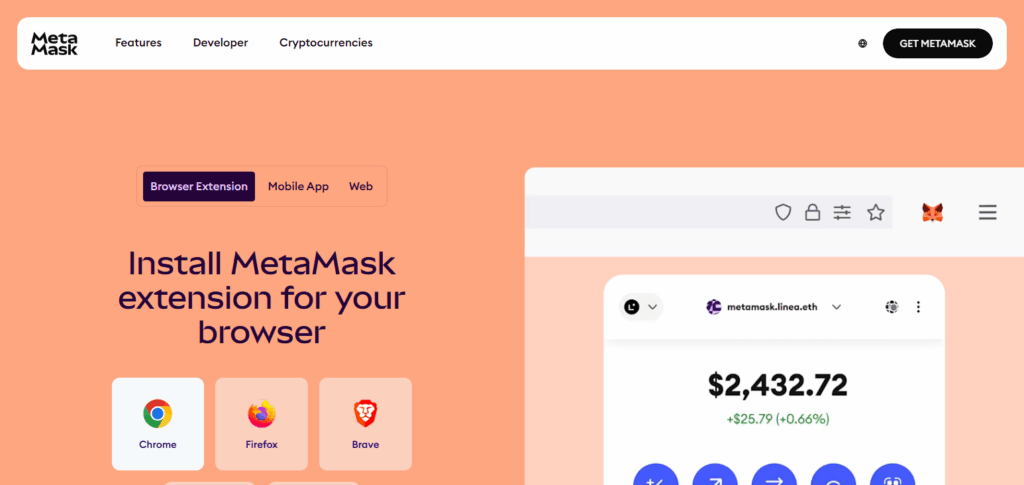

Have ETH in a Self Custody Wallet

Make sure to have a self-custodial wallet like MetaMask or XDEFI ready. Ensure sufficient balance of ETH and gas fee.

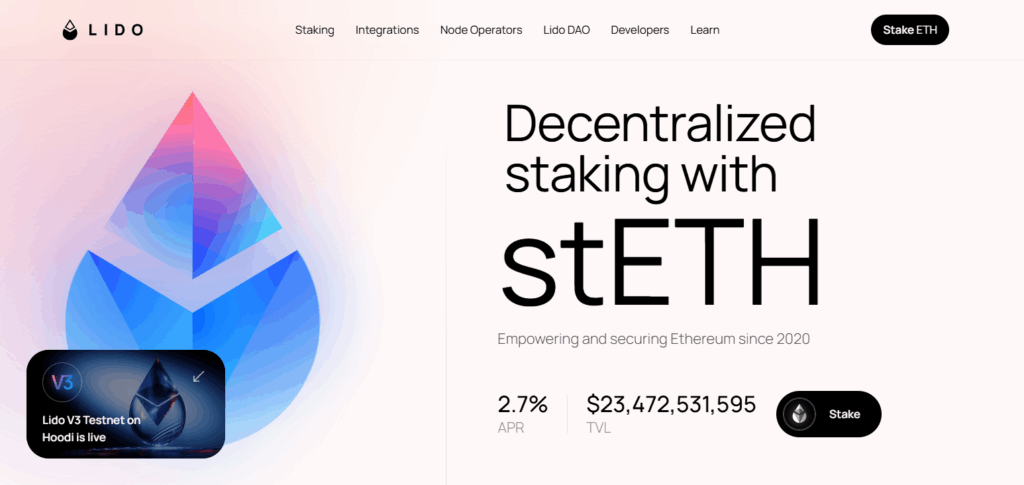

Go to The Site of Lido

Check the site at https://lido.fi — always be wary about phishing sites and validate the URL.

Wallet Connection

Hit “Stake Now.” You can connect your wallet through WalletConnect or the browser extension.

State the Amount You Want to Stake

Indicate the amount of ETH to stake. Lido has no minimum balance requirement.

Confirm the Transaction

Approve the transaction in your wallet. You will get stETH (staked ETH) in exchange.

Automated Earnings of Rewards

As time goes by, your stETH balance will accumulate rewards. stETH can also be utilized in DeFi protocols.

Other Place Where to Stake with a Pool Aggregator

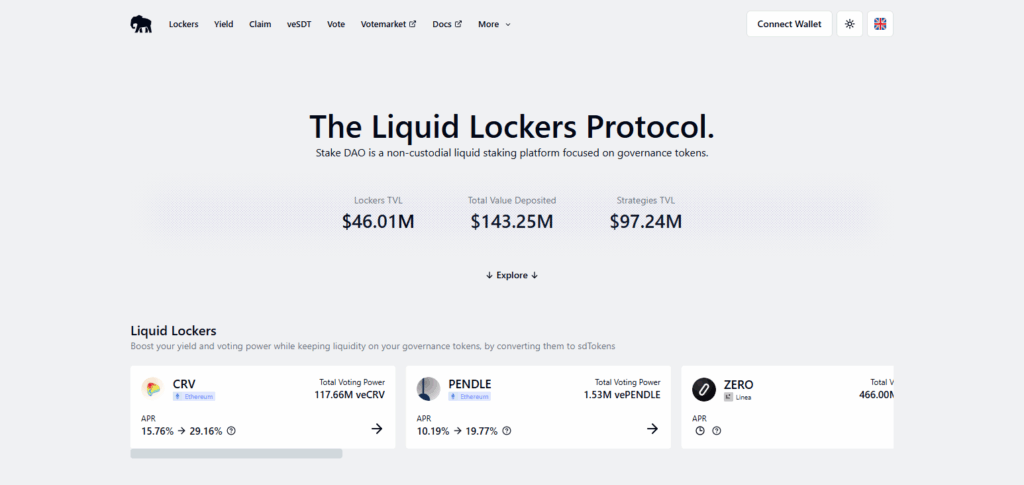

Stake DAO

Stake DAO demonstrates a sophisticated method of pooling by providing a non-custodial, multi-protocol staking interface for users. Its distinctive feature comes from enabling passive governance by integrating yield optimization, enabling users to earn rewards while actively participating in protocol decisions.

Unlike simplistic staking interfaces, Stake DAO combines offer strategized automation for staking on a singular dashboard which enhances users ability to maximize profits, control risk, and retain complete ownership of their assets through one interface.

Rocket Pool

Rocket Pool is a protocol for staking Ethereum which consolidates pools by linking individual stakeholders with those who operate the nodes. Its prominent feature is the support for staked amounts as low as 0.01 ETH, made possible through the tokenized staking system rETH.

This improves accessibility and flexibility for users. Staking is made easier while preserving decentralization by pooling assets and allocating them to a select group of trusted validators. Everyday users can enjoy non-custodial control and scalable participation.

Everstake

Everstake functions as an aggregator of staking pools, enabling users to delegate tokens across multiple blockchains from a single, consolidated interface. What makes it stand out is its support of over 70 proof-of-stake networks which simplifies diversification of staked assets for users.

Everstake provides secure and effective staking through a blend of enterprise-grade validator infrastructure and a simplified interface, which eliminates the need for technical knowledge. Thus, it is perfect for users prioritizing both dependability and adaptability when it comes to staking various assets from one platform.

Benefits of Using a Pool Aggregator

Increased Earnings – Aggregators optimize multi-pool staking for maximum yield.

Minimized Risks – Lower risk of exposed losses due to diversified underperforming or penalized validators.

Staking Made Easier – User-friendly interfaces support effortless engagement with the staking process.

Access Liquidity – Many provide liquid staking tokens, such as stETH, which permit multi-use for staked assets.

Compounding automatically – Certain platforms maximize profits by reinvesting rewards on autopilot.

Clear Reporting and Analytics – View data about performance, fees, and APY live.

Risks and Drawbacks

Exploitable Smart Contracts

The use of smart contracts by aggregators always exposes them to various bugs and exploits.

Asset Slashing

Your staked assets are at risk of being partially lost if the validators of the assets misbehave.

Centralization Risks

A large aggregator may impact network decentralization as they control too much.

Unpredictable Returns

Due to automated strategies employed by aggregators and conditions of the network, returns are not guaranteed.

Custodial Risk

Full control over your assets may be required by some platforms due to their nature of operation.

Tips for Maximizing Staking Rewards

Use Trusted Aggregators – Make sure these are reputable with proven histories and their smart contracts are audited.

Compare APYs – Check multiple aggregators as some may offer better competitive yields than others.

Re-Stake Rewards – Re-staking rewards that are supported can further compound the earnings. So do it on a regular basis.

Strategically Spread Staked Assets – Staking different tokens or aggregators increases the chances of better overall returns.

Track Network Changes – Mark your calendar for the changes in the posted protocol, slashing, and reward mechanisms.

Use Liquid Staking Options – Choose those aggregators that offer the best flexibility through liquid staking tokens.

Pros & Cons

| Pros | Cons |

|---|---|

| Higher staking rewards through optimization | Smart contract risks (bugs, hacks) |

| Reduced risk via validator diversification | Slashing penalties from validator misbehavior |

| Simplified staking process for beginners | Possible centralization of staking power |

| Access to liquidity via staking tokens | Variable returns depending on network performance |

| Auto-compounding features for better ROI | Some platforms may be custodial, reducing full control of your assets |

| Transparent analytics and performance data | Additional platform or service fees |

Conclusion

Using a pool aggregator is a simple and straightforward method for beginners to start earning passive income from their crypto assets.

Through participation in staking, crypto assets earn yield while network security and governance are easier to join through aggregators which simplify the complex process. However, staying alert to smart contract risks or validator penalties are other things to keep in mind. When backed by research and willingness to explore, long-term rewards from the strategy are plenty.