In this article, I will cover Yield Farming with Bridging Tokens, a strategy enabling DeFi users to earn more by cross Shifting assets between blockchains.

Bridging tokens enable obtaining better unlocking access to new opportunities of higher APYs, lower fees, and more liquidity pools which help maximize profit in yield farming. This method provides a perfect blend of cross-chain agility, productivity, and smarter DeFi investment.

What Is Yield Farming?

Yield farming is a strategy in decentralized finance (DeFi) whereby users receive rewards in exchange for lending or staking their crypto assets in liquidity pools. These pools facilitate the operations of decentralized exchanges and lending platforms. In return, participants earn interest, trading fees, or governance tokens.

Yield farming encourages liquidity provision which is vital for the seamless operation of DeFi platforms. The returns, however, differ from protocol to protocol and depend on prevailing market conditions. Despite having the opportunity to earn high profits, there are risks such as impermanent loss, smart contract bugs, and volatile token prices.

What Is Bridging Tokens?

Bridging tokens are forms of cryptocurrency which are moved from one blockchain to another with the help of cross-chain bridges. Ethereum, BNB Chain, and Avalanche operate independently and do not share data. Consequently, bridging tokens facilitate movement of assets between these networks and unlocking DeFi opportunities on different chains.

For instance, ETH can be bridged from Ethereum to Polygon and used on Polygon-based dApps. In general, these tokens are wrapped or represented versions of the original tokens. This ensures effortless cross-chain operations and provides enhanced liquidity, yield farming, and interoperability.

Why Combine Yield Farming with Bridging Tokens?

In decentralized finance, combining yield farming with bridging tokens offers more flexibility, profit, and scalability. Here’s why this technique works so well:

Access to Higher Yields Across Chains: By bridging tokens, assets can be moved to blockchains with a higher APY. For example, liquidity pools on Arbitrum and Optimism often have much higher returns than their Ethereum counterparts because of better incentives or roower competition.

Lower Transaction Fees: Farming on Ethereum is costly because of gas fees. Bridging tokens to lower-cost chains like Polygon, BNB Chain, or Base increases net yield by maximizing income and minimizing expenses.

Expanded Farming Opportunities: Different DeFi protocols and reward schemes are unique to every chain. Users can unlock explore of diverse liquidity pools, vaults, and lending platforms from other chains that are not available on their own by bridging their tokens.

Improved Capital Efficiency: Assets no longer have to remain idle sitting on a high-fee chain. Users can deploy such assets via bridges to low-fee chains, thereby optimizing ROI and reducing opportunity cost.

Early Access to Incentives: Smaller or newer chains tend to incentivize bridged liquidity by offering extra tokens or bonuses. Such bonuses can tremendously enhance profits earned from yield farming.

Risk Diversification: Cross-chain farming helps guard against the over-reliance on one ecosystem. In case one chain has problems like congestion or governance issues, funds that are bridged can be easily moved somewhere else.

Top Platforms Supporting Bridged Yield Farming

Rango Exchange

Rango Exchange offers some of the best-facilitated bridged yield farming owing to its advanced cross-chain routing engine spanning over 60 blockchains, both EVM and non EVM. Its distinct advantage is smooth cross-chain interoperability which allows users to effortlessly transfer assets and capitalize on yields in myriad fragmented DeFi ecosystems from one platform.

Owing to its integration with other major bridges and DEXs, Rango guarantees optimal routing with minimal slippage, positioning it as a dependable and effective multi-chain yield farming hub.

Stargate Finance

Stargate Finance stands out as one of the best platforms for bridged yield farming due to its unified liquidity layer spanning several blockchains. Stargate’s most distinct feature is native-asset bridge ing, which allows users to traverse between chains without the wrapped token friction of other systems, preserving the asset during yield accrual.

This model minimizes gas expenses and other forms of inefficiency. Stargate’s integration with other leading DeFi protocols makes instant liquidity transfer across chains possible, facilitating complex farming strategies with minimal restrictions and enabling easy access to a multitude of high-yield opportunities within a single, safe environment.

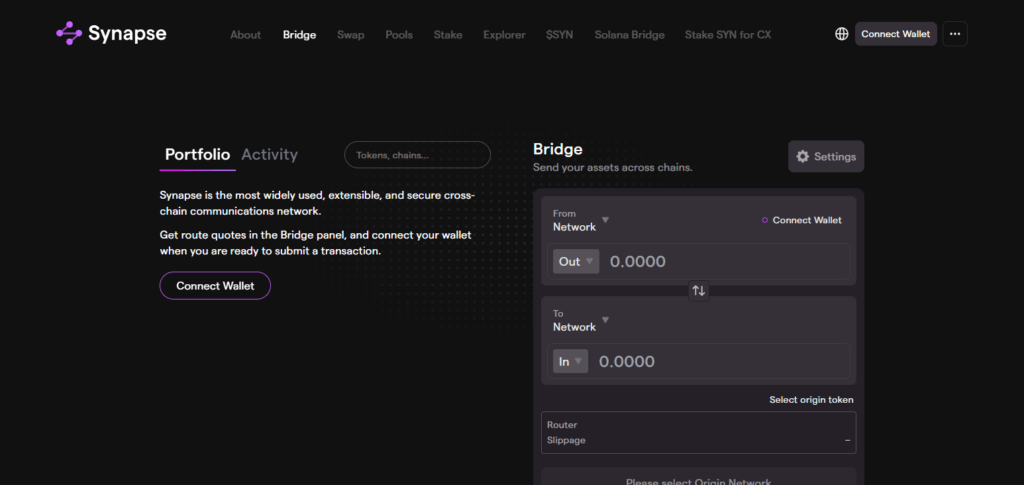

Synapse Protocol

Bridged yield farming is distinguished by Synapse Protocol owing to its atomic transfers and cross-chain native asset liquidity which allows users to bridge and farm in a single transaction. Transactions on supported chains (Ethereum, Polygon, Fantom, Avalanche, BNB Chain, etc.) are executed with minimal fees and slippage due to Synapse’s built-in routing and aggregation.

Its privacy-respecting messaging layer, which secures the transmission of bridging and farming instruction wires, enables Synapse to maintain unique cross-chain competitive advantage. DeFi users are empowered to effortlessly access cross-chain yields due to this effective design.

Risks and Challenges

Vulnerabilities of Bridges: Bridges that span across different chains are one of the most targeted areas that hackers focus on. The exploits can be tremendously damaging in the event that a bridge is hacked.

Risks of Smart Contracts: Farming programs and bridges are built on smart contracts that may contain bugs or weaknesses.

Losses That Are Not Permanent: Users who provide liquidity through volatile pair tokens may experience greater losses than simply holding through time.

Excessive Fees/Premiums Slippage: Swapping or bridging through different chains may lead to slippage and other unpredicted fees. This results in profit earning becoming harder.

Risk of Centralization: Some bridges and protocols are semi-centralized making them subject to governance breakdowns and ineffective control, or censorship.

Uncertainties of Regulations: Bridging assets that span two jurisdictions may put users at risk of vague or shifting legal threats.

Liquidity Loss: Opportunities for yield differ across chains. Performance and exit options becomes a challenge when one side has low liquidity.

Inaccurate Price Oracles: Faulty farming, reward, or liquidation events can result from one of the chains feeding bad delayed or incorrect oracle data.

Strategies to Maximize Returns

Bridge to High Yield Chains: Look for chains that have active yield generating competition or new programs with incentivized APYs (Base, Arbitrum) then relocate liquidity to those chains.

Use Stablecoin Pools: Yield farming using bridged stablecoins ( USDT, USDC) makes it easier to earn yield because impermanent loss is mitigated.

Leverage Yield Aggregators: Services such as Beefy, AutoFarm, and Yearn take care of auto-compounding and thus optimize returns on bridged assets without any manual work.

Check Fees Vrs Expected Reward: One should always measure gas fees, bridging fees versus the identified reward. A lot of low fee chains tend to generate higher net profit.

Spread Pooled Resources Across Varied Chains and Pools: This helps minimize risk as well as increase earning potential due to more diverse opportunities.

Market Condition Timing: Moving assets during bare network fee periods and farming at times of intensive activity within the network can yield higher profit.

Focus On Trust and Audit When Using Cross Bridges: Ensure reliability by using well-trusted bridges that have gone through auditing to reduce chances of losing assets through cross-chain transfer.

Security Tips and Best Practices

Reputed Bridges Only

Use only trusted and audited bridges such as Stargate, Synapse, and LayerZero. Stay away from obscure or non-audited protocols.

Contracts of Tokens Should Be Verified

Take the time to inspect the contract address of tokens received from bridges to ensure there are no fraudulent or harmful tokens.

Avoid Transfer Over Exceeding Limits

Ensure that the bridges are reliable and safe by testing with small amounts before scaling up transfers to ensure reliability first.

Enable Security Features for Wallets

Always keep private keys and seed phrases safe, use hardware wallets, and enable two-factor authentication (2FA).

Check for Phishing Links and Fakes

Access DeFi platforms from official links only. Save them as bookmarks to eliminate getting tricked through phishing links.

Stay Updated for Exploits

Monitor project socials along with DeFi Security alerts to receive updates and early warnings about protocol risks or attacks.

Claim Rewards Remotely Without Delay

Smart contracts undergo changes and hacks; periodically harvesting helps in reducing exposure to unclaimed hacks.

Avoid Concentration Across Protocols and Chains

Compromise on one bridge or platform impacts one’s assets greatly. Spread assets to lessen the impact.

Audit Reports Should Be Needed To Be Reviewed

The last audit of the bridge and farming platform should not be ignored. Ensure all audited bridges and farming platforms are checked out first before use.

Use Multisig or Permissioned Wallets for Large Funds

For large DeFi strategies, you might want to look into using multisig wallets or advanced tools such as Gnosis Safe for greater protection.

Future of Yield Farming with Bridged Assets

Yield farming’s future prospective with bridged assets is likely to expand substantially as cross-chain interoperability develops. Investments in infrastructure like LayerZero, CCIP, and modular blockchain frameworks promise faster, cheaper, and safer bridges.

They will allow frictionless cross-chain movement of assets, and more efficient multi-chain farming will be possible. As DeFi ecosystems merge and fragment the farming silos, streamlined access to liquidity, optimal yield, and lower tech barriers will make it easy to interact across ecosystems. Moreover, Lockring Layer 2s and zk-rollups will increasingly boost scalability, lower gas fees, and make bridged farming a go-to DeFi approach.

Conclusion

With the use of bridging tokens, yield farming serves as a powerful advancement in DeFi strategy, allowing users to tap into greater yields, lower fees, and diverse opportunities across multiple blockchains.

Users are able to maximize their returns and retain agility in a swiftly changing market by strategically providing liquidity and leveraging cross-chain mobility.

However, higher potential means greater risk—security, risk management, and platform selection become crucial considerations. For the informed and vigilant, however, bridging tokens into yield farming can significantly optimize efficiency, diversification and profit in decentralized finance.