In this article I will cover Best Crypto Portfolio Rebalancing Tools for cryptocurrency investments that mitigate risks and maintain optimal asset allocation strategy .

Because the cryptocurrency market is extremely volatile, employing the right rebalancing tool improves returns and eases portfolio management in the longs run. These tools are designed to cater to traders at every level, offering features that support diverse strategies and objectives.

Key Point & Best Crypto Portfolio Rebalancing Tools List

| Platform | Key Point |

|---|---|

| Quantum AI | AI-based trading automation platform (claims high returns; lacks clarity). |

| Crypto.com | Full-suite crypto platform with exchange, wallet, Visa card & DeFi tools. |

| Kubera | Personal finance tracker integrating crypto, bank, stocks & real estate. |

| CoinStats | Crypto portfolio tracker with wallet integration, DeFi & analytics. |

| Delta Investment Tracker | Multi-asset tracker for crypto, stocks & funds; real-time syncing. |

| Token Metrics | AI-driven crypto analytics & investment insights; premium-focused. |

| Altrady | All-in-one crypto trading terminal with smart orders & portfolio sync. |

| Coinigy | Pro trading platform offering multi-exchange trading & charting tools. |

| CoinLedger | Crypto tax software for tracking trades & generating tax reports. |

| CoinGecko | Leading crypto data aggregator with prices, charts & fundamental metrics. |

1.Quantum AI

Quantum AI has emerged as one of the best crypto portfolio rebalancing tools owing to its automation driven by adaptive machine learning.

Unlike traditional rebalancing tools, it continuously monitors market activity and reallocates assets to mitigate risks and maximize return. Its volatility reaction and foretelling abilities allow users to maintain optimum portfolio balance with ease, hence making it suitable for both active investors and long-term traders.

| Feature | Details |

|---|---|

| Platform Type | AI-driven portfolio optimization tool |

| Technology | Utilizes quantum computing and AI for dynamic portfolio adjustments |

| Transaction Fees | Competitive fees based on portfolio size |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Automated rebalancing, risk management, and sentiment analysis |

| Security | Advanced encryption and secure data handling |

| Additional Features | Real-time market insights and customizable portfolio strategies |

2.Crypto.com

Crypto.com shines as a cryptocurrency portfolio rebalancing tool by merging rebalancing with trading, staking, and a crypto Visa card within its ecosystem.

Its competitive edge lies in users being able to fully automate with target allocations—such as the platform automatically rebalancing to achieve set targets along predefined market conditions and rules. This strategy, which is completely automated at the surface level, facilitates hands-off growth while still maintaining control and convenience. All of this is done from a mobile app.

| Feature | Details |

|---|---|

| Platform Type | Crypto portfolio management and rebalancing tool |

| Technology | AI-driven auto-rebalancing and thematic crypto baskets |

| Transaction Fees | Competitive fees based on portfolio size and transactions |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Auto-rebalancing, diversification, and thematic investment strategies |

| Security | Advanced encryption and secure data handling |

| Additional Features | Real-time market insights, customizable baskets, and mobile app integration |

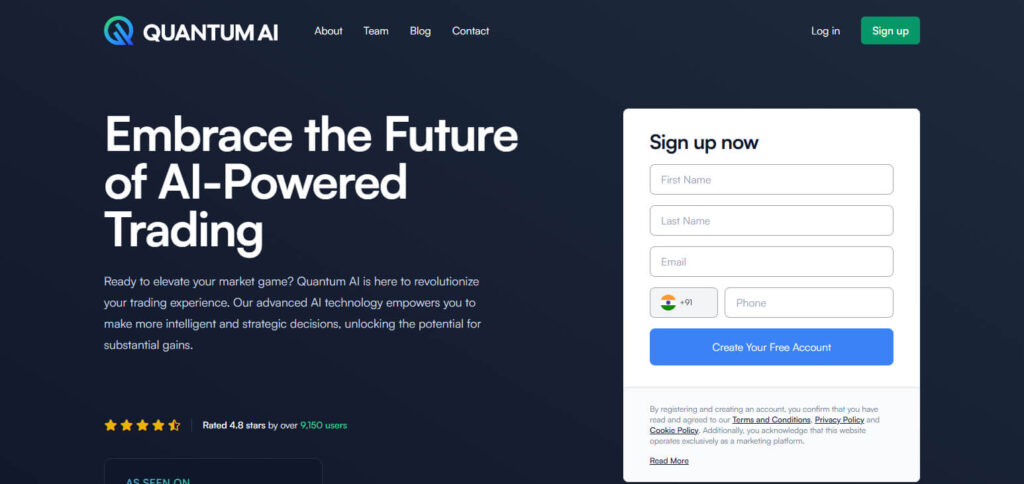

3.Kubera

Kubera is a crypto portfolio rebalancing tool that is an outlier because it integrates both traditional and digital assets into one streamlined dashboard.

The ability to track and rebalance to such a wide array of holdings—crypto, stocks, real estate, and even bank accounts—is a rebalancer’s unique strength, providing users with a holistic view of their finances.

By offering automatic value updates and customizable rebalancing logic, Kubera helps investors ensure optimal balance and long-term growth without the hassle of platform-hopping.

| Feature | Details |

|---|---|

| Platform Type | Comprehensive portfolio tracking and rebalancing tool |

| Technology | Supports integration with 20,000+ banks, brokers, and crypto wallets |

| Transaction Fees | No transaction fees; subscription-based pricing |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Net worth tracking, portfolio rebalancing, and multi-asset management |

| Security | Bank-level encryption and secure data handling |

| Additional Features | Tracks traditional and alternative assets like real estate, NFTs, and collectibles |

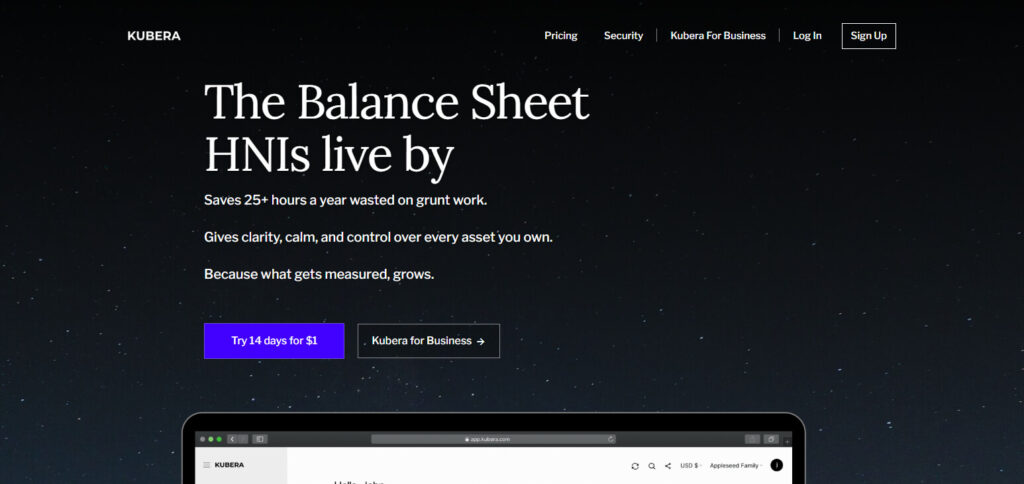

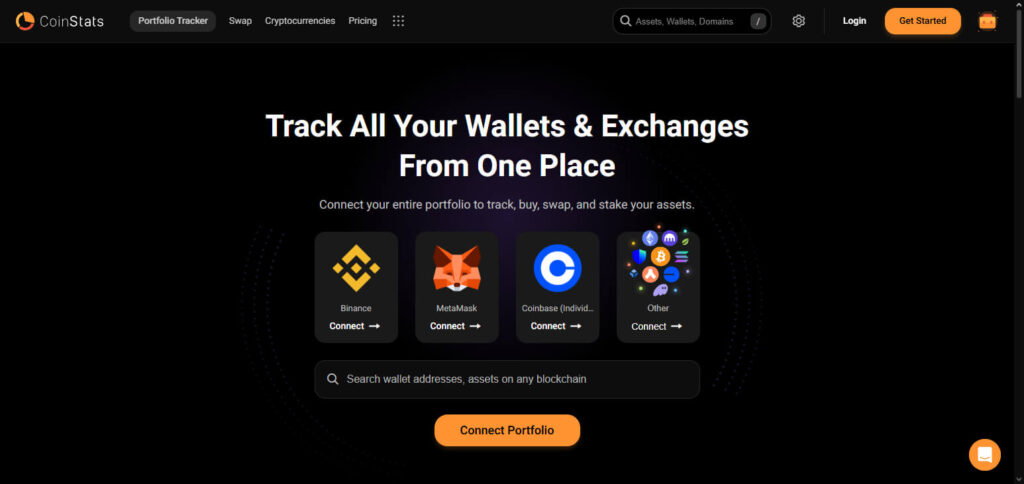

4.CoinStats

CoinStats is considered one of the best tools for rebalancing crypto portfolios owing to its proprietary blend of DeFi and centralized assets within one ecosystem.

It also offers the unique advantage of wallet and exchange connections which permit automatic portfolio updates, custom rebalancing processes, and self-sustaining strategies. Analytics and performance indicators guide user adjustments allowing precise control, enabling further optimization of the portfolio in real-time, making it ideal for investors who need that level of detail.

| Feature | Details |

|---|---|

| Platform Type | Crypto portfolio management and rebalancing tool |

| Technology | Supports integration with 300+ exchanges, wallets, and 100+ blockchains |

| Transaction Fees | Competitive fees based on portfolio size and transactions |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Auto-rebalancing, portfolio tracking, and performance analytics |

| Security | Advanced encryption and secure data handling |

| Additional Features | Real-time market insights, customizable alerts, and mobile app integration |

5.Delta Investment Tracker

Delta Investment Tracker provides insights across diverse asset categories, including cryptocurrency, stocks, and ETFs, fully integrating them into a single user interface.

Customers can specify target allocations and receive proactive notifications about rebalancing, enabling their investment strategies to be executed with minimal intervention.

Its unique strength lies in its holistic tracking feature that combines various investment types into a centralized portfolio. The powerful notification system, in tandem with effortless navigation and universal application access, positions Delta as the best solution for anyone interested in diversification within a single application.

| Feature | Details |

|---|---|

| Platform Type | Multi-asset portfolio tracking and rebalancing tool |

| Technology | Supports integration with brokers, exchanges, and wallets |

| Transaction Fees | No transaction fees; subscription-based pricing |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio tracking, performance analytics, and rebalancing strategies |

| Security | Bank-level encryption and secure data handling |

| Additional Features | Real-time market insights, customizable alerts, and mobile app integration |

6.Token Metrics

Token Metrics utilizes AI insights to suggest allocation decisions and serve as a Crypto portfolio management tool. Its greatest strength is offering predictive analytics and machine learning models to recommend asset weightings considering trend forecasts and performance metrics.

This algorithmic approach is redefining automated rebalancing from a mere operational necessity into a discernable competitive edge and is ideal for users keen on sophisticated portfolio management and intelligent foresight.

| Feature | Details |

|---|---|

| Platform Type | AI-driven crypto research and portfolio optimization tool |

| Technology | Utilizes AI and machine learning for portfolio rebalancing and token analysis |

| Transaction Fees | Subscription-based pricing; no transaction fees |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio rebalancing, token ranking, and market sentiment analysis |

| Security | Advanced encryption and secure data handling |

| Additional Features | Model portfolios, trading signals, and real-time market insights |

7.Altrady

Altrady is considered one of the best tools for crypto portfolio rebalancing because of its smart trading automation, and real-time multi-exchange integration.

Its unique advantage is the setting of predefined rebalancing strategies that work simultaneously across various exchanges, thus providing users with greater control over diversified assets.

The platform analytics and alerts help in making data-driven decisions which are relevant and time-sensitive, dealing with active traders who precision and speed.

| Feature | Details |

|---|---|

| Platform Type | Crypto trading and portfolio management tool |

| Technology | Supports integration with 15+ popular crypto exchanges |

| Transaction Fees | No additional fees; depends on the connected exchange |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio rebalancing, risk management, and automated trading strategies |

| Security | Advanced encryption and secure API connections |

| Additional Features | Smart trading terminal, grid bots, and real-time market alerts |

8.Coinigy

Coinigy is considered to be one of the best crypto portfolio rebalancing tools due to its sophisticated cross-exchange trading terminal that integrates with more than forty-five exchanges.

Its proprietary edge lies in providing unparalleled access and sophisticated charting that permits real-time modifications of portfolios on various systems.

Clients are able to track the value of their assets and manually or using semi-automatic methods rebalance them accurately, with the support of comprehensive market data. This is why Coinigy is best suited to advanced traders who need high control and prefer an integrated solution for managing portfolios.

| Feature | Details |

|---|---|

| Platform Type | Crypto portfolio management and trading tool |

| Technology | Supports integration with 45+ exchanges and wallets |

| Transaction Fees | No additional fees; depends on the connected exchange |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio tracking, rebalancing, and real-time market data |

| Security | Advanced encryption and secure API connections |

| Additional Features | Charting tools, price alerts, and mobile app integration |

9.CoinLedger

CoinLedger stands out in crypto portfolio rebalancing tools because it automates tax calculations while tracking the portfolio. Its exceptional characteristic is in assisting users to rebalance not only for performance, but also for tax efficiency.

CoinLedger helps users allocate tax more intelligently by analyzing capital gains and suggesting strategic reallocations. By explaining and optimizing the tax burden, investors can do careful tax planning along with investment management. This is particularly beneficial for wealth accumulation.

| Feature | Details |

|---|---|

| Platform Type | Crypto portfolio tracking and tax reporting tool |

| Technology | Supports integration with 800+ exchanges, wallets, and blockchains |

| Transaction Fees | Free to use; optional fees for tax report downloads |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio tracking, tax reporting, and cost basis analysis |

| Security | Bank-level encryption and secure data handling |

| Additional Features | Tax-loss harvesting, real-time market insights, and automatic cost basis tracking |

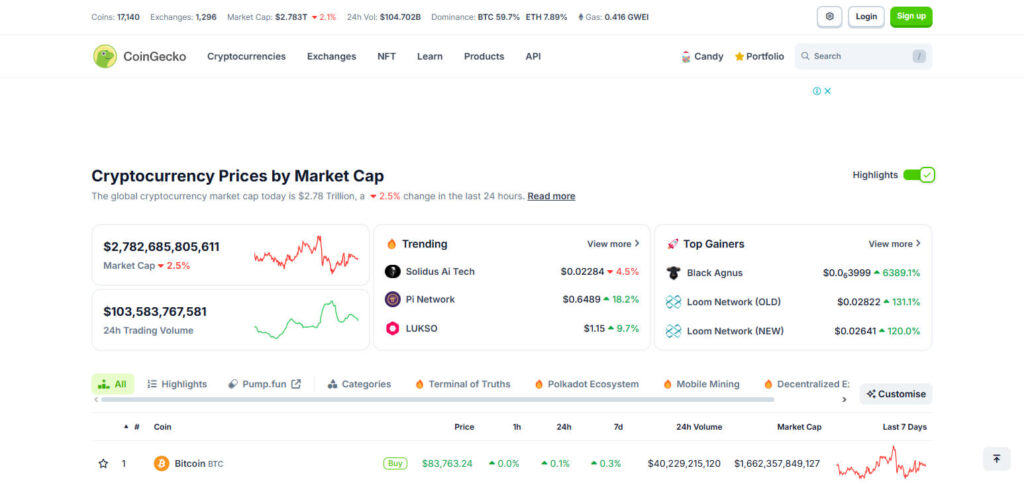

10.CoinGecko

CoinGecko is unique among portfolio rebalancers for a given cryptocurrency due to the extensive market information provided, which helps users make better rebalancing choices. What sets it apart is its comprehensive, real-time tracking of price changes, token specifics, and market emotions, featured in dynamic portfolios on personalized dashboards.

Though not automated, CoinGecko’s information-laden platform allows for manual rebalancing with unmatched clarity, making it supreme for those investors who prefer to have full control while still using accurate information provided by the market.

| Feature | Details |

|---|---|

| Platform Type | Crypto portfolio tracking and market analysis tool |

| Technology | Provides API integration for portfolio tracking and rebalancing |

| Transaction Fees | Free to use; no transaction fees |

| KYC Requirements | Minimal KYC required for account setup |

| Use Cases | Portfolio tracking, market insights, and rebalancing strategies |

| Security | Advanced encryption and secure data handling |

| Additional Features | Real-time price updates, customizable alerts, and historical data analysis |

Conclusion

To sum up, the best rebalancing tools for cryptocurrency portfolios give unique advantages relevant to different categories of investors.

Ranging from automation in Quantum AI to ecosystem integration in Crypto.com to cross-asset tracking in Kubera, these platforms optimize the portfolio management process. While Altrady and Coinigy provide precision to active traders, others like CoinStats, Delta, and Token Metrics leverage insights to build plans.

Smart rebalancing adds tax considerations in CoinLedger, while manual adjustments are guided by information in CoinGecko. Together, these platforms simplify portfolio optimization and management—